“High corporate governance standards are essential to the success of a company and the Board is committed to putting in place the requisite mechanisms to take the Company beyond compliance.”

DEAR SHAREHOLDER

I am delighted to introduce the Corporate Governance report outlining the Company’s approach to corporate governance. As outlined elsewhere in the report, the Board remains committed to high standards of corporate governance. This report sets out and explains in clear terms the processes in place which are essential for delivery of long-term success, while ensuring that the Company complies with all applicable laws and regulations and, of course, meets the requirements of our shareholders and their representative bodies.

We are reporting against the UK Corporate Governance Code (2016 version) (the “Code”) for this report, which was published by the Financial Reporting Council ('FRC') and is available to view at www.frc.org.uk. We welcomed the publication of the new UK Corporate Governance Code released in 2018 by the FRC, particularly its broader view of corporate governance and renewed focus on long-term sustainable success. The changes in the revised UK Corporate Governance Code are also aligned with the Board’s increased focus on engagement with the workforce and more generally the culture needed to sustain long-term success. Throughout the year, the Board have been mindful of the letter and spirit of the revised UK Corporate Governance Code and we look forward to reporting to you on our application of this version next year.

This report has been prepared and approved by the Board and, on behalf of the Board I confirm that during the financial year ended 30 June 2019, the Company applied the principles of, and was compliant with the provisions of the Code other than where stated on page 43 of this report. In this report, we provide not only the regulatory and statutory assurances required from us, but we also try to provide a deeper understanding of the workings of our Board.

This report explains what the Board actually does and describes how it is responsible for setting the codes and values of the Company as well as how it interacts with its shareholders and other key stakeholders. The report also explains the Company’s strategic goals and its performance against them.

We also discuss in this report how the Board monitors its effectiveness in order to ensure that is has the strength and capability to lead the Company to continued success. In 2019, Independent Audit were engaged as an external facilitator to carry out an evaluation of the effectiveness of the Board and each of its committees. The evaluation found that the Board continues to be working well and functioning in an effective way. Details of the external evaluation can be seen on pages 46 to 47.

Since the last report, the composition of the Board has changed significantly. Details of the changes can be found in the Nomination Committee Report on pages 55 to 57 however these are summarised as follows:

- Debbie Hewitt, previously Senior Independent Director, retired from the Board on 7 November 2018, following the conclusion of the 2018 Annual General Meeting;

- Nick Hewson was appointed as Senior Independent Director on 7 November 2018 and became the Chairman of the Nomination Committee at the same time;

- Vanda Murray was appointed as Chair of the Remuneration Committee on 7 November 2018;

- Steve Morgan, the founder of Redrow, retired from his position as Chairman on 31 March 2019;

- John Tutte, previously Group Chief Executive, was appointed as Executive Chairman of the Company on 1 April 2019; and

- Matthew Pratt, previously Regional Chief Executive, was appointed as Chief Operating Officer on 1 April 2019.

Our 2019 Annual General Meeting will be held on Wednesday, 6 November 2019 and the Notice of Annual General Meeting together with Explanatory Notes will be sent to you separately.

Finally on behalf of the Board, for those who wish to attend our 2019 Annual General Meeting, the Board looks forward to meeting with you.

GRAHAM COPE

Company Secretary

4 September 2019

Introduction

This report sets out the Company’s compliance with the Code issued by the Financial Reporting Council and describes how the governance framework is applied by the Company.

Compliance with the UK Corporation Governance Code

The Directors have considered the contents and requirements of the Code and confirm that throughout the year ended 30 June 2019 the Company has been compliant with the provisions of the Code, as explained further in this report, other than as set out in the table below.

| Provision | Reason for non-compliance | Explanation |

A.3.1 – the Chairman should be independent upon appointment |

John Tutte, previously the Chief Executive, succeeded Steve Morgan as Chairman on 1 April 2019 and therefore did not meet the independence criteria set out in B.1.1 of the Code on appointment. |

The succession plan for Steve Morgan, being the founder and previous Chairman of the Company, was considered extensively by the Nomination Committee. John Tutte has a wealth of experience and knowledge of the Company and the Board considered it to be in the best interests of the Company for him to succeed Steve as Chairman. The appointment has delivered on the Nomination Committee’s objective to provide for a smooth transition following Steve stepping down. Matthew Pratt, previously a Regional Chief Executive of the Company, was appointed as Chief Operating Officer with effect from 1 April 2019, which allowed the Company to maintain a clear division of responsibilities between himself and John Tutte as the Executive Chairman. The division of these responsibilities can be seen on page 44. A written statement of the division of these responsibilities is reviewed and approved by the Board each year. See page 56 for a more detailed explanation of the appointment. |

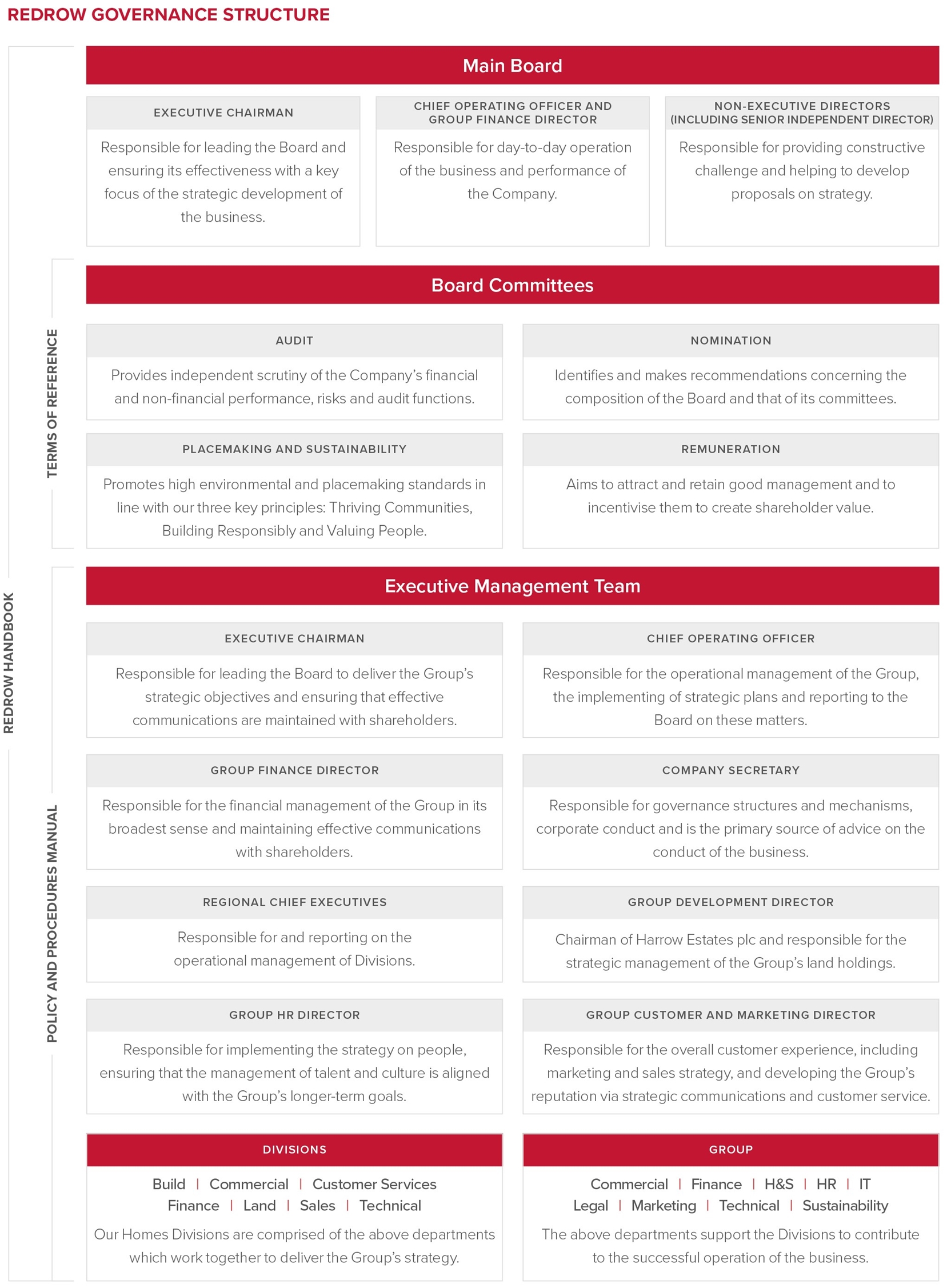

Governance Structure

Governance is a key priority of the Board and the governance structure is set out in the diagram opposite. Each component within the structure is governed by a particular set of rules, whether it is the Redrow handbook, the policies and procedures manual and/or the terms of reference. Each of these are regularly reviewed and are updated in line with best practice and legislative or regulatory changes.

Future Governance Considerations

The Board keeps fully apprised of developments in corporate governance given the importance governance plays in the long-term success of a company. There were a number of key developments introduced in 2018, which will apply to the Company’s financial year ending 30 June 2020. The developments of particular note were:

1. Section 172 reporting – the new requirement to include an explanation in the Annual Report of how the Directors have carried out their statutory duty to act in a way which they consider, in good faith, would be most likely to promote the success of the Company for the benefit of its members as a whole, and in doing so have regard to key stakeholders (including employees, suppliers, customers and communities); maintaining a reputation for high standards of business conduct; environmental impact; and likely long-term consequences of decisions. Whilst the inclusion of a specific report relating to the section 172 duty is a new requirement, the duty itself was introduced with the Companies Act 2006 and has therefore been carried out by the Directors since its imposition.

2. CEO pay ratio – the new requirement to include the pay of the most senior Executive Director calculated against the 25th, median and 75th percentile of UK employees’ pay and presented in the Directors’ Remuneration Report, along with a supporting narrative. Such disclosure shall also assist the Remuneration Committee in fulfilling their widened remit of taking into account workforce remuneration and related policies when setting Director remuneration.

3. Culture – a renewed focus on culture has been introduced with the 2018 Code, whereby the Board should ensure that there is a culture which aligns values of the Company with strategy and should also assess long-term value preservation. Steps have been implemented during the year to ensure that culture, values and strategy remain high on the Board’s agenda.

4. Board level workforce representation – the new requirement to ensure that the workforce is represented at Board level to enable the Board to more easily understand the views of the wider workforce. The Board has discussed the various methods available for such representation and has appointed Vanda Murray as the designated Non-Executive Director responsible for facilitating such engagement.

Throughout the year the Company has been mindful of these developments, along with others, and has accordingly introduced new practices, or adapted existing practices where appropriate. We look forward to reporting fully on these matters in our 2020 Annual Report.

The Board

The Board comprises an Executive Chairman, two Executive Directors and three Independent Non-Executive Directors, one of which acts as the Senior Independent Director.

EXECUTIVE CHAIRMAN AND CHIEF OPERATING OFFICER - division of responsibilities

The Company has separate roles for the Executive Chairman and Chief Operating Officer, ensuring that there is a clear division of responsibilities at the head of the Company between the running of the Board and the operational responsibility for the running of the Company’s business, as required by the Code.

The division of responsibility and accountability between the roles is well defined and using such a balanced approach ensures that no one individual has unfettered powers of decision.

EXECUTIVE CHAIRMAN

John Tutte, as Executive Chairman, is primarily responsible for:

- leading the Board to ensure optimum effectiveness;

- encouraging a culture of openness and debate;

- taking a leading role in determining the Board’s composition and structure;

- ensuring that effective communications are maintained with shareholders; and

- meeting with the Non-Executive Directors without the presence of the Executive Management Team.

CHIEF OPERATING OFFICER

Matthew Pratt, as Chief Operating Officer, is responsible for:

- operational management of the Group;

- implementing strategic plans with the assistance of the Executive Management Team;

- ensuring that the visions and values of the Company are properly communicated across the Group; and

- reporting on these to the Board.

These responsibilities held by Matthew Pratt are the responsibilities previously held by John Tutte when he occupied the position of Group Chief Executive of the Company.

SENIOR INDEPENDENT DIRECTOR

Nick Hewson was appointed as the Senior Independent Director on 7 November 2018, having succeeded Debbie Hewitt in this position.

Nick has a wealth of experience as a Non-Executive Director and, having been on the Board since 2012, has a good understanding of the business

The following additional responsibilities fall within the remit of the Senior Independent Director:

- acting as a sounding board for the Executive Chairman and supporting him in ensuring the Board is effective and that constructive relations are maintained;

- being available to shareholders in order to understand their issues and concerns in order to relay to the Board; and

- leading the evaluation of the performance of the Executive Chairman and obtaining views from other Directors.

NON-EXECUTIVE DIRECTORS

The role of the Non-Executive Directors within the Company is essential in order to view the Group objectively and provide constructive challenge to the Executive Directors and scrutinise performance. They have a good understanding of the business and bring a range of skills and experience to the discussions of the boardroom. The diversity and skills brought into the Company by the Non-Executive Directors is crucial to developing the strategy of the Group.

The Non-Executive Directors play a vital role in occupying seats on the Board’s Committees and they are positioned in such way that the Committees benefit from their expertise and background.

COMPANY SECRETARY

The Company Secretary acts as secretary to the Board and its Committees and his appointment and removal is a matter for the Board as a whole. The Company Secretary is a Member of the Executive Management Team and all Directors have access to his advice and services. In certain circumstances, Board Committees and individual Directors may wish to take independent professional advice in connection with their responsibilities and duties, and, in this regard, the Company will meet the reasonable costs and expenses incurred and the Company Secretary will assist in arranging such advice.

Directors' and Officers' Insurance

The Company has directors’ and officers’ insurance in place which insures Directors against certain liabilities, including legal costs.

Appointments and Re-Elections to the Board

The appointments of the Non-Executive Directors are generally made for three-year terms. Following the assessment on the effectiveness of the Directors, the Nomination Committee will make recommendations to the Board on re-appointments.

The Nomination Committee has recommended the re-appointment of each of the Executive Directors and Non-Executive Directors. The Nomination Committee report can be found on pages 55 to 57.

The Board believes that presently the balance of Non-Executive and Executive Directors is effective and contains the appropriate mix of skills and experience for the Board to continue successfully. The composition is compliant with principle B.1.2 of the Code as the ratio of Independent Non-Executive Directors to Executive Directors, excluding the Chairman, is 3:2 (60%).

The Board, having been informed of the principles and provisions of the Code on election and re-election, including that there should be a formal, rigorous and transparent procedure for the appointment of new directors to the Board, and that re-election is subject to continued satisfactory performance, has decided that all Directors will be submitting themselves for re-election at the Annual General Meeting.

The Board has satisfied itself that all Directors who will be submitting themselves for re-election continue to perform satisfactorily. Details of appropriate Annual General Meeting Resolutions will be found in the Notice of Annual General Meeting which will be sent to shareholders separately.

Appointments to External Boards

Prior to Executive Directors and Non-Executive Directors taking on any additional responsibility outside of the Group, an assessment is undertaken to determine whether this will compromise their ability to commit sufficient time to the Company to properly discharge their responsibilities or create any potential conflicts. In making the assessment, the Board considers the mandates attributable to such positions, in line with the scoring mechanism used by Institutional Shareholder Services, to determine whether a person is overboarded. The Board does not consider that any of its Directors are overboarded and is satisfied that sufficient time and energy is devoted to the Company by each Director.

Role of the Board

The Board is responsible for putting in place the strategic plans for the Group and providing the leadership required in order to achieve its vision and goals.

There are matters which the Board delegate to Committees, the Executive Management Team and other relevant management bodies in order to ensure that the Group is operating efficiently and effectively.

In order to ensure that the Board fulfil their statutory duties as Directors, there is a formal schedule of matters reserved specifically for the Board’s decisions. The matters reserved include:

- approval of the Group’s long-term objectives and strategy;

- approval of the Annual Report, preliminary and half-yearly financial statements, trading updates and the recommendation of dividends;

- approval of any significant changes in accounting policies or practices; any changes relating to capital structure and approval of treasury policies;

- ensuring the maintenance of a sound system of internal control and risk management;

- assessing the prospects and viability of the Group;

- approval of corporate acquisitions or disposals, significant land purchases or contracts;

- changes to the size, structure and composition of the Board;

- approval of significant policies, including the Group’s Health and Safety policy;

- review of overall corporate governance arrangements; and

- appointment and removal of the Company Secretary.

Long-term performance and shareholder value relies on high quality corporate governance and the Board is responsible for maintaining strong governance practices and regularly reviewing the Group’s governance structure as illustrated on page 42.

Board Meetings

The Board meets regularly and frequently, not less than six times during the year and maintains a close dialogue, as appropriate, between meetings. Board meetings are held at the Company's head office or divisional offices when visits are frequently made to a selection of developments accompanied by the local Management Team. Board papers are distributed sufficiently in advance of the meetings to allow adequate time for review to enable informed debate and challenge at meetings and include key strategic, operational and financial information.

Where a Director is unable to attend a meeting, they are encouraged to discuss any issues arising with the Executive Chairman or Chief Operating Officer as appropriate. If a Director has a concern about the running of the business, the minutes should accurately reflect this. Should any Director resign from their position as a result of unresolved concerns in the Company, they are requested to submit a written statement to the Executive Chairman outlining their concerns for circulation to the Board. There were no statements received of this nature for the year ended 30 June 2019.

Attendance by individual Directors at Board meetings is set out below.

Table of Attendance

| Name | Role | Attendance at Meetings |

| Steve Morgan* | Chairman | 4/4 |

| John Tutte | Executive Chairman | 6/6 |

| Matthew Pratt** | Chief Operating Officer | 2/2 |

| Barbara Richmond | Group Finance Director | 6/6 |

| Debbie Hewitt*** | Senior Independent Director | 2/2 |

| Nick Hewson | Senior Independent Director | 6/6 |

| Sir Michael Lyons | Non-Executive Director | 6/6 |

| Vanda Murray | Non-Executive Director | 6/6 |

* Steve Morgan stepped down as Chairman on 31 March 2019 and attended all 4 meetings which were held from 1 July 2018 to 31 March 2019.

** Matthew Pratt was appointed as Chief Operating Officer on 1 April 2019 and attended both meetings which were held from 1 April 2019 to 30 June 2019.

*** Debbie Hewitt stepped down as Senior Independent Director on 7 November 2018 and attended both meetings which were held from 1 July 2018 to 7 November 2018.

Board Balance and Independence

The Board considers that it is of a size and has a balance of skills, knowledge and experience that is appropriate for its business. The Executive Management Team provides the Board with an appropriate view of the detail of the business and the benefit of their significant collective experience of the UK house building industry and that enables it to discharge their respective duties and responsibilities effectively. The Non-Executive Directors bring a wealth of experience and understanding from outside the Company which enables them to challenge and help develop proposals on the Company’s strategy. All Non-Executive Directors holding office during the year ended 30 June 2019 are considered to be independent.

The details of the Directors’ respective experience are set out in their biographical profiles on pages 40 to 41.

Under the Code, at least half the Board, excluding the Chairman, should comprise Non-Executive Directors determined by the Board to be independent. The Board currently comprises one Executive Chairman, two Executive Directors and three Independent Non-Executive Directors in compliance with the Code.

Relationship Agreement

The Company is party to a Relationship Agreement with Bridgemere Securities Limited and Steve Morgan, which regulates the relationship between the parties and complies with the requirements of the Listing Rules, including Listing Rule 9.2.2AR(2)(a) and Listing Rule 6.1.4DR. In accordance with the requirements of Listing Rule 9.8.4R(14), the Board confirms that the Company complied with the independence provisions set out in the Relationship Agreement during the period under review, and, so far as the Company is aware, Bridgemere Securities Limited, Steve Morgan and their associates complied with the independence provisions set out in the Relationship Agreement during the period under review.

Board Performance Evaluation

In line with the Code, each year a formal performance evaluation of the Board and its Committees is undertaken.

Last year, the evaluation highlighted that there was possible scope for a more rigorous evaluation of the performance of the Board. With this in mind, and in accordance with the Code, Independent Audit were engaged to undertake an external formal evaluation of the performance of the Board and each of its committees during the year ended 30 June 2019. Other than the board evaluation, Independent Audit has not undertaken any work of any kind for the Company.

Given the significant period of change which the Board was going through, with a number of key Board members changing in the year, the Executive Chairman and the Company Secretary met with Independent Audit to discuss the objectives of the review, following which a tailored questionnaire was produced by Independent Audit.

The questionnaire was completed by all members of the Board and each member of its Committees. Members of the Executive Management Team and key external advisors were also invited to participate in the relevant questionnaires. The purpose of widening the participant pool was to gain a deeper understanding of the perception of the Board from non-Board members, which was a useful feedback tool.

Independent Audit compiled a report on the effectiveness of the Board following receipt of all responses and they were invited to display their findings at the meeting of the Board in June 2019. In summary, the results were very positive with interaction between members of the Board and Committees and the Executive Management Team continuing to be strong. The main observations from the evaluation were:

- the Board works on a basis of trust and openness and is making the right impact;

- the quality of chairmanship was highly regarded in promoting inclusive discussions;

- meeting arrangements were rated highly, with sensible agendas and useful board papers;

- there was unanimous agreement that the organisation has a good focus on compliance and the Board have good oversight of the Group’s financial heath, organisational controls and cyber risks; and

- Board members were clear on what the Board wants to achieve and there is a good balance between short-term performance and long-term consequences.

The evaluation also identified the following areas for improvement which will continue to be addressed over the coming year:

- renewed focus on preparing for crises which could impact the Group and ensuring that contingencies and mitigations are in place;

- ensuring that the Board allocates sufficient time to overseeing organisational culture to ensure that it aligns with the Board’s expectations; and

- possible scope for further consideration of how emerging technology in the market could bring strategic opportunities and risks.

As a result, the Board considers that it continues to operate effectively with meetings to facilitate and debate decision making.

2018 Evaluation

| Recommendations | Action taken |

| Continued focus on longer term strategic objectives of the Group | More time dedicated to dealing specifically with the Group’s long-term strategic objectives in the Board meeting. |

| Further consideration for the longer term succession planning of the Executive Management Team | Remained as a priority on the Board’s agenda, recognising that careful succession planning of key personnel is an important factor to the long-term success of the Company. |

| Scope for a more rigorous evaluation of performance | During the year, Independent Audit were engaged to conduct a formal external review of the Board and each of its Committees and they were invited to display the findings of the evaluation directly to the Board. |

Professional Development

The Board recognises that a structured appraisal process and good training are important requirements across the Group. The Board receives regular presentations and briefings from those responsible for key Group disciplines. In addition, the Board maintains close working relationships with the Executive Management Team and the divisional Management Teams.

The Company Secretary assists the Executive Chairman in the co-ordination of the comprehensive induction programme of all Directors following their first appointment.

The programme for the Non-Executive Directors is specifically designed to encompass the full breadth of the business and includes visits to operating businesses. The programme is tailored accordingly to:

- provide an understanding of their role within the Company;

- build an understanding of how the Board operates within the structure of the Group;

- introduce key Group personnel and external advisors;

- enhance their knowledge of the Group’s culture and business; and

- if applicable, prepare the Director for Committee memberships by additionally providing induction material relevant to the specific committee.

Ongoing training continues after appointment and the Executive Chairman endeavours to review the training and development needs of the Directors at least annually. The aim is to ensure the further enrichment of their skills and experience so that they continue to fulfil their role effectively on the Board and its Committees.

During the year, formal appraisals of the Chief Operating Officer and the Group Finance Director were undertaken by the Executive Chairman.

The Executive Chairman and all Non-Executive Directors had an annual appraisal conducted by the Senior Independent Director.

Committees

The Board is supported by Audit, Nomination, Remuneration and Placemaking and Sustainability Committees and their memberships, roles and activities are set out in separate reports; the Audit Committee report can be found on pages 50 to 54; the Nomination Committee report on pages 55 to 57; the Remuneration Committee report on pages 60 to 79 and the Placemaking and Sustainability Committee report can be found on pages 58 to 59.

Each Committee has Terms of Reference approved by the Board and the minutes of the Committee meetings are circulated, and the Committee Chairmen provide reports to the Board.

The Audit Committee and the Nomination Committee are chaired by Nick Hewson, the Remuneration Committee is chaired by Vanda Murray and the Placemaking and Sustainability Committee is chaired by Sir Michael Lyons.

The Board completed a performance evaluation of each of its Committees during the financial year ended 30 June 2019. The evaluation reports were discussed at a meeting of the Committees and it was concluded that they were contributing and functioning effectively and were complying with their Terms of Reference.

Capital Structure

The information of the capital structure of the Company is included in the Directors’ Report on pages 81 to 82.

Diversity

The principle of boardroom diversity is strongly supported by the Board. It is the Board’s policy that appointments to the Board will always be based on merit, so that the Board has the right individuals in place, and recognises that diversity is an important consideration as part of the selection criteria used to assess candidates to achieve a balanced Board.

The table below sets out the current position of the Company on a gender basis.

| Female | Male | |

| Main Board | 2 (33%) | 4 (67%) |

| Executive Management Team | 2 (22%) | 7 (78%) |

| Direct reports to Executive Management Team | 12 (34%) | 23 (66%) |

| Redrow employees at June 2019 | 810 (35%) | 1,515 (65%) |

Workforce Engagement

The Board believes that greater engagement with the workforce is essential to preserving long-term value. Valuing People is a fundamental part of the Group’s strategy and understanding the views of employees and actively encouraging their participation sits highly on the Board’s agenda. During the year, the Company has:

1. Enhanced employee communication via the new intranet, Engage

Engage is available for all employees of the Company and is now the hub for sharing news and communications across the business. It encourages employees to actively participate and have a voice in decisions being made by the Company.

2. Introduced employee engagement meetings

Each department across the business has an elected representative who attends regular engagement meetings to put forward the views and ideas of the department. Each employee has access to their engagement representative and has the opportunity to discuss matters arising from these meetings. All meeting materials and action plans following meetings are made available to all employees via Engage.

3. Implemented changes following feedback from employees through the INsight survey

The INsight survey is distributed annually to all employees and in 2019 there was a 91% participant rate. The feedback from employees was anonymised.

Following the results, workshops were carried out with each team to discuss the findings and feedback was collated by the Engagement team. Resulting from the feedback, commitments and themes for the year were posted on Engage with regular progress reports posted on these.

The following are just a few examples of changes made as a result of employee engagement through the INsight survey:

- Enhanced maternity and paternity leave;

- Introduction of flexible working; and

- Introduction of enhanced flexible holidays.

4. Introduced a direct communication channel to the Board

Employees now have the opportunity to email the Board and Executive Management Team to ask them any question relating to the business. Employees have the option to anonymise their name, division and job title. All questions asked are discussed at the next Board meeting and responses are posted on Engage for all employees to view.

The objective of such an initiative was to ensure that the Board is reachable at all levels across the business and to reinforce the culture of openness and transparency throughout the Group.

5. Increased focus on the promotion of share ownership through employee share plans

The Company supports employee share ownership at all levels as it directly aligns employee interests with those of shareholders.

Share ownership encourages employees to take a wider view of the Group. Thinking like a shareholder, as well as an employee, provides for a deeper perspective and encourages the workforce to be more inquisitive as to whether they can individually and collectively improve to create even more shareholder value.

Shareholder Engagement

The Company announces its financial results half-yearly, and, immediately following their publication, undertakes formal presentations to equity analysts. These presentations are available on the Company’s website.

During the year ended 30 June 2019, the Chairman, the Chief Executive Officer/Chief Operating Officer and the Group Finance Director, together with the Senior Independent Director, also held a number of meetings with significant shareholders and subsequently briefed the Board on issues discussed at these meetings.

Following the full year and half-yearly results’ announcement in September 2018 and February 2019, the Executive Chairman and the Group Finance Director met current and potential significant shareholders. This included visits to London and feedback from these meetings was independently collated and disseminated to the Board.

Last year the Annual General Meeting took place at the offices of Instinctif Partners in London. All Directors attended the Annual General Meeting on 7 November 2018, save for Barbara Richmond who was unable to attend the meeting due to an unexpected medical condition and therefore sent her apologies. Barbara was fully apprised of the matters of the meeting upon her return.

Shareholders are encouraged to attend the 2019 Annual General Meeting, which presents an opportunity for all shareholders attending to ask questions formally during the meeting and informally afterwards to the Directors.

Formal notification of the 2019 Annual General Meeting will be sent to Shareholders at least 21 working days in advance.

The Company’s website, redrowplc.co.uk, gives access to current financial and corporate information.

GRAHAM COPE

Company Secretary

4 September 2019