"I am pleased to present the Directors’ Remuneration Report for the 52 weeks ended 28 June 2020."

In line with the reporting requirements, this remuneration report is split into three sections:

Annual Statement

The annual statement sets out an overview of how our policy operates, the context in which remuneration decisions for the 52 weeks ended 28 June 2020 were made and our approach to paying Executive Directors in 2021 following changes to executive directors’ roles.

Remuneration Policy

Our previous remuneration policy comes to the end of its three-year life and therefore a new policy will be put to a shareholder vote at the 2020 AGM. As described in more detail below, the Committee, following consultation with major shareholders is rolling forward the 2017 policy for one further year. The rolled over policy is set out in this remuneration report and will be subject to a binding shareholder vote at the 2020 AGM.

Annual Report on Remuneration

This describes in further detail the pay outcomes for the 52 weeks ended 28 June 2020 and the proposed implementation for the 2021 financial year. It also includes CEO pay ratio reporting for the first time and other details including executives’ shareholding and historic outcomes.

Impact of Covid-19 on Executive Directors’ Remuneration

As set out in detail in the Operating and Financial Review sections, the COVID-19 pandemic which emerged in the last quarter of our financial year was more disruptive to our business than any we can recall in recent times. In these unprecedented times, the Board’s main priority has been to safeguard the well-being of our workforce and customers.

Throughout this challenging period for the industry, the management team has demonstrated great resilience and have collectively taken responsible actions in response to the COVID-19 pandemic.

- On 27 March 2020 we announced the orderly and safe closure of all the Group’s developments and, on that date, the entire directorate volunteered to take a 20% cut in salary and pensions. This was not reinstated until sites reopened and a significant proportion of furloughed staff had returned to work.

- In the case of John Tutte, he volunteered to continue with a 20% reduction in his salary and pension until he steps back to a non-executive role after the November 2020 AGM.

- The Group worked proactively to manage its cash flow and a significant proportion of employees were furloughed. As the Group’s cash flow position improved from a phased return to construction, the Group decided not to utilise the Government’s Job Retention Scheme and has returned all payments received under the scheme. The Executives have agreed to forgo any bonus entitlements in respect of the 2019/20 year. It should be noted that a number of non-profit related targets had been met when they were assessed at the end of the year.

The Remuneration Committee is pleased that the management team has acted responsibly and that its swift actions during this period have considered fully the wider stakeholder experience and left the business in good shape in what remains a very uncertain environment.

Inevitably, the impact of the pandemic has had an impact on the annual bonus and LTIP vesting outcomes for the year ending 28 June 2020. As disclosed in last year’s report, the 2020 annual bonus was based on a scorecard of measures. Half the bonus was based on PBT which was not achieved. The other half of the bonus was based on order book, land, customer service, health and safety and personal objectives and performance against these objectives resulted in 37.9% out of a potential 50% being achieved. However, reflecting the impact on Redrow’s wider stakeholders, the executive directors agreed, prior to the bonus achievement being assessed or awarded, to voluntarily forgo any bonus for the year and the Remuneration Committee is supportive of this action.

The LTIP awards granted in 2017 were subject to stretching EPS and ROCE conditions measured over the three financial years ending 28 June 2020. EPS for the year was 32.9p and ROCE was 9.2%, reflecting the impact of COVID-19 in the final year of assessment, which meant neither measure reached their respective threshold targets and thus the award will lapse in full in November 2020.

Remuneration Policy Renewal

The Redrow Directors’ Remuneration Policy was last approved by shareholders at the November 2017 Annual General Meeting and is due for renewal at the 2020 meeting. The Remuneration Committee was part way through a comprehensive review of directors’ remuneration and was looking to consult with shareholders and proxy advisory agencies on changes to its Remuneration Policy in the final quarter of the 2020 financial year.

However, as a consequence of the unprecedented impact of COVID-19 on the business in Q4 and as the Board’s focus turned to more immediate priorities, the Remuneration Committee did not feel it was appropriate to bring forward a new Remuneration Policy with potentially significant changes at the 2020 AGM. Instead, we intend to rollover the current 2017 Policy and put forward a revised policy for approval in 2021 when there should be greater clarity on the market environment. The concept of a rolled over policy was included in guidance issued by The Investment Association and our major shareholders made it clear during a comprehensive consultation exercise that they were supportive of our rollover proposal.

The ‘rolled over’ policy will require shareholder approval at the November 2020 Annual General Meeting. This policy will be on largely the same terms as the current one, albeit with some commitments on compliance with good practice and with the provisions of the UK Corporate Governance Code built in.

The Remuneration Committee is cognisant of the focus on executive pensions and this is reflected in the reduction that has been applied to Matthew Pratt’s contribution rate since taking on the Chief Executive role on 1 July 2020 (see below). The Remuneration Committee has committed to reduce all executive directors’ contribution rates to the workforce rate of 7% of salary by 1 July 2023. This commitment is included in the rollover policy and the new policy that we intend to put to a shareholder vote in 2021.

Under the current policy, on cessation of employment, good leavers’ outstanding share awards vest on their normal vesting date and, in the case of LTIP awards, these are reduced pro-rata for time and a 2-year holding period would continue to apply. This potentially creates alignment with shareholders for up to 5 years after leaving employment. As part of the forthcoming directors’ remuneration policy review, the Remuneration Committee will seek to include a post-cessation shareholding guideline in line with evolving market and good practice from next year.

Board Changes

As previously announced, it was intended that John Tutte would move to Non-Executive Chairman from 30 June 2020. However, due to the impact of the pandemic on the business, the Board asked John Tutte to remain as Executive Chairman until the Company’s AGM in 2020 to support the senior management team get the business back to full operation and the Board was grateful that John agreed to this request. However, it remains John’s intention to retire from the Board ahead of the AGM in 2021 and, as announced on 20 April 2020, Matthew Pratt took up the position of Group Chief Executive on 1 July 2020.

Matthew Pratt’s salary in his new role as Chief Executive from 1 July 2020 has been set significantly below market levels at £540,000 to allow him time to gain experience and develop into the role. The Remuneration Committee intends to increase his salary to £625,000 from 1 July 2021 subject to performance in his new role over the next 12 months. The Committee believes the phasing of base salary is appropriate and, having conducted a comprehensive internal and external CEO search, the Committee is comfortable that a £625,000 salary suitably reflects the scope and responsibility of the role for a business of Redrow’s scale and is appropriately positioned against peers in the industry and other FTSE 250 comparable businesses. A £625,000 salary (applicable from 1 July 2021 subject to performance) is 2.5% higher than John Tutte's salary as Executive Chairman which was agreed in July 2019.

Upon taking up the role, Matthew’s pension contribution was reduced to 7% of salary which is in line with the pension contribution rate across the Redrow workforce. His bonus opportunity and LTIP grant levels will remain in line with the existing policy opportunities, at 100% of salary and 150% of salary respectively. The Remuneration Committee intends to review these incentive opportunities and the choice of performance measures over the next 12 months to ensure they remain competitive for a company of Redrow’s size and scale and reflect the short and medium-term priorities of the Group as it emerges from the pandemic.

The Remuneration Committee determined that John Tutte’s salary should remain at £610,000 for the period he is in post as an executive and that he will not participate in the 2020/21 annual bonus scheme or receive an LTIP award in 2020.

John volunteered to reduce his salary by 20% (in line with the voluntary reduction communicated by the Board on 9 April 2020) and has since volunteered to extend this reduction until he steps back to being Non-Executive Chairman at the November 2020 AGM. Therefore, his salary will be £488,000 (reduced from £610,000). John will continue to receive a contribution towards pension (by reference to his lower salary) and his standard benefits while he continues as Executive Chairman.

John’s fee in his role as Non-Executive Chairman following the 2020 AGM shall be set at £300,000p.a. This fee rate reflects the value and experience he provides to the business and the likely level of time commitment required during these challenging times. A lower fee is likely to apply to the next Non-Executive Chairman.

Aligning Our Short-Term Priorities

Each year we review the choice of annual bonus measures to ensure they remain relevant and reflect the business strategy. As the business comes to terms with the pandemic, The Committee believes there should be greater focus on sales and growing profit. Therefore, 50% of the bonus will continue to be based on stretching PBT targets based on the current outlook and 24% will be based on delivering sales volume and revenue as consumer confidence grows.

Customer service remains of paramount importance, as does the health and safety of our employees. Therefore, 14% of the bonus is based on customer service targets and 12% on H&S underpinned by COVID-19 compliance on our sites.

The Committee believes a mix of profit, revenue, customer service and H&S aligns the executive team with the key priorities of the business over the next 12 months.

Setting meaningful LTIP targets at the current time is challenging given the uncertainty surrounding COVID-19 and the economic outlook. Therefore, the Remuneration Committee intends to grant LTIP awards at the normal time, in September, and it will set the measures and targets within six months of grant. The targets will be communicated to shareholders at the time they have been agreed and set. The level of challenge associated with these targets will take into account the business outlook at the time.

The Remuneration Committee has discretion to adjust the number of shares vesting from the award if it considers that the vesting outcome is not sufficiently reflective of the underlying performance of the Company and to the extent the Committee believes there have been windfall gains.

Looking Forward

Redrow’s senior management team has shown great leadership, resilience and energy in recent months and the Remuneration Committee will continue to ensure its approach to setting senior executive pay is commensurate with that of shareholders, employees, customers, suppliers and other stakeholders.

As announced in July, after three years as a non-executive at Redrow I will be stepping off the Board at the November 2020 AGM. I will be handing over the responsibility of chairing the Remuneration Committee to Nicky Dulieu with whom I have worked closely over the last year. Under Nicky’s chairmanship, the Remuneration Committee will resume its review of the Remuneration Policy from the start of the next calendar year and will seek the views of shareholders in helping to shape the new policy.

Please feel free to contact me or Nicky, via the Company Secretary, if you would like to provide feedback on the design of the new policy.

I look forward to your support at the upcoming AGM.

Vanda Murray OBE

Chair of the Remuneration Committee

This report has been prepared in accordance with the UK Corporate Governance Code, the relevant provisions of the Listing Rules and Schedule 8 of the Large and Medium-sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013.

2020 Directors' Remuneration Policy

As described in the Annual Statement, the Remuneration Committee has decided to roll forward the 2017 shareholder approved Remuneration Policy for a further year (effective following shareholder approval at the 2020 Annual General Meeting) with the intention of putting forward a revised policy to a binding shareholder vote in 2021 when there should be greater clarity on the market environment following the impact of the COVID-19 pandemic.

Therefore, there are no material changes between this Policy and the 2017 one. The two exceptions are:

- Pension contribution rates for newly appointed executive directors will be aligned with the workforce rate and a commitment has been provided for all executive directors to be workforce aligned by 1 July 2023. The pension section of the policy table has been updated to reflect this.

- The clawback policy has been updated to reflect additional triggers introduced.

This 2017 Policy was originally formed as part of discussions between the Committee, the Executive Directors, Human Resources Director and external advisors and with the feedback from stakeholders. The decision to roll forward the 2017 Policy for a further year was made by the Committee, following discussions with the wider Board and a comprehensive consultation exercise with the Group’s major shareholders and proxy voting agencies in 2020.

Remuneration Strategy

This Policy has considered the provisions of the 2018 UK Corporate Governance Code and in particular the following six factors:

Clarity

- The Policy has a clear aim; to incentivise and reward for the delivery of our strategy

- This Policy is an update of the previous Policy, with minimal changes so is well understood both internally and externally

- Each component of remuneration is clearly explained in the Policy table, including its purpose, how it is operated, the maximum potential and any relevant performance measures

- Full disclosure of performance measures and assessments is provided for shareholders’ consideration

Simplicity

- The Policy reflects standard UK market practice, with the operation of an annual incentive and a single long-term share plan, full details of which are set out in the Policy table

- All payments are in the form of cash or Redrow plc shares, there are no artificial structures used to deliver remuneration

Risk

- The Committee has the ability to use its discretion to override the formulaic outturns of the incentive plans if it is felt appropriate

- Comprehensive malus and clawback provisions operate in both incentive plans, providing the ability to recover or withhold payments if appropriate

Predictability

- Appropriate individual (and where necessary aggregate) limits are set out in the Policy and within the respective plan rules so outcomes can be predicted

- The possible reward outcomes under different performance scenarios are shown in the “Illustration of Remuneration Policy” section on page 86.

- In operating the Policy, the Committee continually monitors the performance of in-flight incentive awards so that it is well aware of potential outcomes

Proportionality

- The outcomes of our incentive plans are directly aligned to the delivery of our strategy

- Outcomes are assessed against multiple metrics to ensure performance is considered on a broad basis

- The Committee has the ability to use its discretion to override the formulaic outturns of the incentive plans if it is felt appropriate

Alignment of culture

- A key focus of our Policy is to promote long-term sustainable performance which is reflective of the business culture

- Incentive outcomes rely on strong performance across a broad selection of measures which are important to our stakeholders

Policy Table for Executive Directors

Operation

Salaries are determined by the Committee taking into account all relevant factors such as: the size and complexity of the Company, the scope and responsibilities of the role, the skills and experience of the individual and performance in role.

The Committee’s assessment of the competitive market positioning of base salaries is based on consideration of market data from UK companies of similar size and complexity and companies in the house-building sector.

Salaries are normally reviewed annually, with any changes effective at the start of the financial year.

Maximum

There is no prescribed maximum salary. Any salary increases will normally be in line with those of the wider workforce.

The Committee has discretion to award larger increases where it considers this appropriate, such as to reflect (for example):

- a significant change in the size and complexity of the Company;

- an increase in scope and responsibility of the role, or a change in role;

- an Executive Director being moved to market positioning over time; and

- an Executive Director falling below competitive market positioning.

Performance framework

N/A

Operation

Benefits may include: a company car (or equivalent cash allowance), private medical insurance, permanent health insurance, fixed term group income protection and a death in service benefit, and where appropriate any tax payable thereon.

Executive Directors may also participate in all-employee share plans on the same basis as other employees.

The Committee has discretion to include, where it considers it appropriate to do so, other benefits to reflect specific individual circumstances, such as housing, relocation, travel, or other expatriate allowances.

Maximum

Benefit provision, for which there is no prescribed monetary maximum, is set at an appropriate level for the specific nature and location of the role.

Participation in all employee share plans is subject to statutory limits.

Performance framework

N/A

Operation

Individuals are eligible to participate in the Company’s Defined Contribution (DC) pension scheme or receive a pension allowance cash supplement.

Executive Directors who are members of the Company’s Defined Benefit (DB) pension scheme will continue to receive benefits under the terms of that scheme. There will be no new entrants or accrual of future benefits under the DB scheme.

Maximum

The maximum DC contribution/cash supplement (in respect of a financial year) is 20% of base salary.

Any new executive directors appointed to the Board will have a maximum pension contribution of 7% of salary in line with the current wider workforce contribution rate.

All executive directors will have a pension contribution rate of no more than 7% of salary from 1 July 2023.

Performance framework

N/A

Operation

The Committee determines participation levels each year. Targets are set by the Committee for the relevant financial year and are assessed following the year end.

A portion (currently 50%) of any bonus earned will be deferred into Redrow shares, which are awarded in the form of nil-cost options which vest after a period set by the Committee. Currently, half of the deferred shares vests after one year and half after two years, subject to continued employment.

Following exercise of a vested deferred share award, participants will be entitled to receive an amount equal to the aggregate of any dividends which they would have been entitled to receive as a shareholder during the period between the grant and satisfaction of the award.

In future years, the Committee retains the discretion to change the deferred amount and/or lengthen the deferral period.

Where appropriate (for example, in limited circumstances where it may not be possible to grant a share award due to technical reasons), the Committee may determine that deferral is in the form of an equivalent cash award (which in all other respects mirrors the terms of the deferred share awards).

Clawback provisions apply to both the cash and deferred elements.

Maximum

100% of salary

Performance framework

Performance is assessed against key financial and operational performance measures linked to the delivery of the strategy and shareholder value determined each year by the Committee.

The 2020/21 performance measures are set out on page 90.

The Committee retains discretion to adjust the measures and/or weightings in future years to reflect prevailing financial, strategic and operational objectives of the business or of the individual. However, a minimum of 50% of the total will always be based on key financial measures.

No bonus will be payable for performance below threshold levels set by the Committee.

The Committee has discretion to adjust the level of payout if the outcome from a formulaic assessment does not appropriately reflect underlying business performance.

Operation

Awards may be made under the Redrow plc 2014 Long Term Incentive Plan (LTIP).

Awards are normally in the form of nil-cost options. The Committee may also determine that awards are made in the form of conditional share awards or as an equivalent cash award (for example, in limited circumstances where it may not be possible to grant a share award due to technical reasons) which in all other respects mirrors the terms of the LTIP.

Awards normally vest subject to the satisfaction of performance conditions measured over a period of at least three years. Vested award will normally be subject to an additional holding period of two years.

Clawback provisions apply.

Awards incorporate the right to receive (in cash or shares) the aggregate value of dividends paid on vested shares between the vesting date and the date on which the awards are released following the holding period, on such basis as the Committee may determine, which may assume the reinvestment of these dividends in shares on a cumulative basis.

Maximum

The maximum award which may be granted in respect of a financial year will normally not exceed 150% of salary.

However, in exceptional circumstances only, the Committee may make awards of up to 200% of salary.

Performance framework

The LTIP is based on performance measures aligned to the creation of long-term shareholder value, measured over a performance period of at least three years. An explanation of the approach to the current performance measures is set out on page 90.

For threshold performance, 20% of the awards would normally vest.

The Committee retains discretion to include additional or alternative financial performance measures and/or adjust the weightings in future years to reflect prevailing strategic or operational objectives of the business aligned with shareholder value creation.

Performance conditions applicable to LTIP awards may be amended if an event occurs which cause the Committee to consider that an amended performance condition would be more appropriate and not materially less difficult to satisfy.

The Committee reserves the right to make any remuneration payments and payments for loss of office (including exercising any discretions available to it in connection with such payments) notwithstanding that they are not in line with the Remuneration Policy set out above where the terms of the payment were agreed (i) before 10 November 2014 (the date the Company’s first shareholder approved Remuneration Policy came into effect); (ii) before the Remuneration Policy set out above came into effect, provided that the terms of the payment were consistent with the shareholder-approved Remuneration Policy in force at the time they were agreed; or (iii) at a time when the relevant individual was not a director of the Company and, in the opinion of the Committee, the payment was not in consideration for the individual becoming a director of the Company. For these purposes “payments” includes the Committee agreeing awards of variable remuneration and, in relation to an award over shares, the terms of the payment are “agreed” at the time the award is granted. The Committee may make minor amendments to the Remuneration Policy (for regulatory, exchange control, tax or administrative purposes or to take account of a change in legislation) without obtaining shareholder approval.

Choice of performance measures and target setting

For the annual bonus and LTIP, performance measures are chosen which help to drive and reward the achievement of the Group’s strategy and also provide alignment between employees and shareholders. The Committee reviews measures each year to ensure they remain appropriate and reflect the future strategic direction of the Group. Targets for each performance measure are set by the Committee with reference to internal plans and external expectations. Performance is typically measured on a ‘sliding scale’ so that incentive payouts increase pro-rata for levels of performance in between the threshold and maximum performance targets.

Differences in pay policy for employees and Executive Directors

The principles applied to the remuneration of Executive Directors are essentially the same as those for the Company. The difference between pay for Executive Directors and employees is that for Executive Directors the variable pay element forms a greater proportion of the overall package and the total remuneration opportunity is higher to reflect the increased responsibility of the role. While remuneration practices vary across the full employee population, they are based on the same broad principles which underpin the policy for Executive Directors set out above. For example:

- Remuneration packages should be sufficient to attract and retain the calibre of talent necessary to deliver the strategy for shareholders;

- A significant number of Group employees are eligible to participate in bonus or incentive arrangements designed to drive a shared responsibility for delivering performance for shareholders;

- Redrow operates a number of share incentive plans to encourage employee share ownership and align employees with the interests of shareholders. The deferred bonus plan is cascaded to senior management. All employees are entitled to participate in the Save As You Earn (SAYE) share option plan under which employees are granted options and encouraged to save in order to invest in Company shares; and

- All employees are eligible to participate in the defined contribution pension scheme.

Consideration of conditions elsewhere in the Company

When setting the Remuneration Policy for Executive Directors, the Committee has regard to the pay and employment conditions of employees within the Company. The Committee did not consult directly with employees when formulating the Remuneration Policy for Executive Directors. The Committee considers salary increases within the business but does not formally consider any other comparison metric.

Consideration of shareholder views

The Committee engages with all major independent shareholders and shareholder advisory groups, when developing this Remuneration Policy. Views expressed during this engagement are taken into account by the Committee in finalising the proposals. The Committee will subsequently inform all of those consulted of planned changes as a result of the consultation and the final proposed Policy. We will be conducting a comprehensive consultation exercise as part of the development of the 2021 Policy.

Charitable donations

Where an individual waives any current or future right or entitlement to a remuneration payment or other benefit, which they would otherwise be eligible to receive under any of the components set out in the Policy Table on pages 82 to 84, the Committee may determine that a charitable donation, which is, in its opinion, equivalent to the value of that payment or benefit, may be made by the Company.

Executive shareholding guidelines

Executive Directors are expected to build and retain a shareholding in the Group at least equivalent to 200% of base salary. Until the shareholding guideline has been met Executives will be required to retain all vested deferred bonus shares and LTIP shares on a net of tax basis.

Clawback

For awards under the annual bonus plan (including deferred share awards) and awards made since the introduction of the 2014 LTIP, the Committee has discretion to clawback awards in the event of a material misstatement of the Company’s audited financial results or employee misconduct. Awards made from 2019/20, included additional triggers relating to an error in the calculation of a performance condition and circumstances which the Committee considers sufficient to have, or had potential to have, caused reputational damage will also apply.

In such circumstances, at any time prior to the fifth anniversary of the payment of any cash bonus or vesting of a deferred bonus/ LTIP award, the Committee has discretion to:

- reduce, cancel or impose further conditions on outstanding deferred bonus/LTIP awards; or

- require the participant to repay (in cash or shares) some or all of the value delivered from a deferred bonus/LTIP awards; and/or

- require the participant to repay some or all of any cash bonus received.

Where a charitable donation has been made in accordance with the Remuneration Policy, clawback will not apply.

For deferred bonus plan awards, in the event of a material misstatement of the Company’s audited financial results or employee misconduct, any unexercised awards will lapse immediately and the participant will forfeit any shares previously acquired under awards made under that plan.

Corporate events

Unvested awards under the deferred bonus plan and LTIP will normally vest early in the event of a takeover or winding-up of the Company and, in the case of the deferred bonus plan, if the Company goes into administration or a voluntary arrangement is proposed with its creditors. In these circumstances, deferred bonus awards vest in full and LTIP awards vest taking into account the relevant performance conditions and, unless the Committee determines otherwise, time pro rating to reflect the proportion of the performance period that has elapsed. Awards may also be rolled over for equivalent awards in a different company. If the Company is or is likely to be affected by a demerger, special dividend, delisting or other event which in the Committee’s opinion, may affect the current or future value of the Company’s shares, the Committee may allow some or all of the awards to vest. The extent to which LTIP awards vest in these circumstances will be calculated on the same basis as set out above for a takeover. The terms of awards may be (a) in the event of any variation of the Company’s share capital, delisting, special dividend or distribution, demerger or other event which may in the Committee’s opinion, affect the current or future value of the Company’s shares, adjusted or (b) amended in accordance with the plan rules.

Illustration of Remuneration Policy

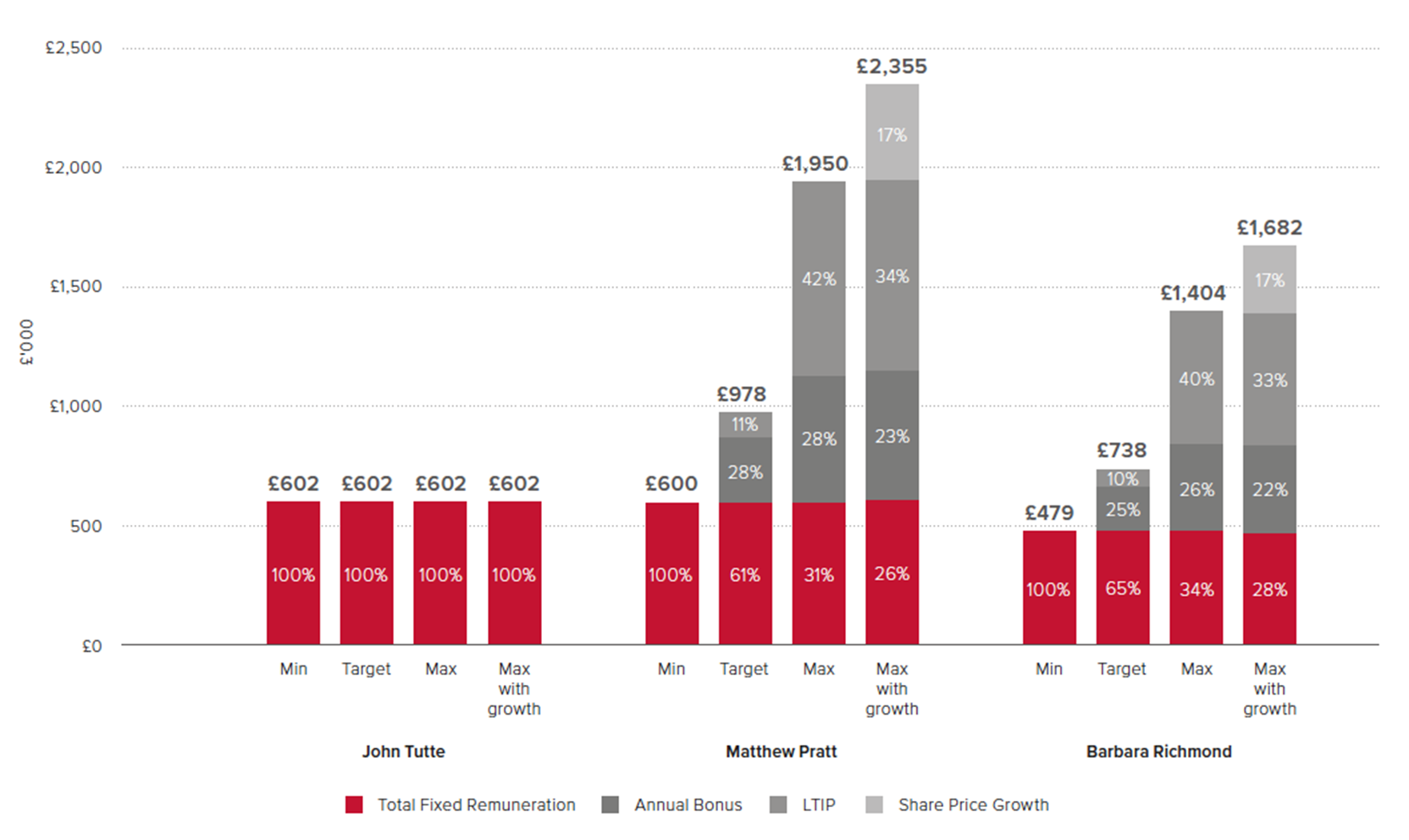

The charts below illustrate the potential value of the remuneration packages for the Executive Directors under the following scenarios (no share price growth is assumed):

- Minimum – reflects fixed pay only (base salary and pension contributions as at 1 July 2020 and benefits included using the disclosed values for the year ended 28 June 2020, except for the Chairman, where it reflects his proposed ongoing position of no variable incentives and only his time as Executive Chairman up to the November 2020 Annual General Meeting);

- Target – reflects fixed pay, target bonus (50% of salary) and LTIP awards vesting at threshold (i.e. 20% of salary); and

- Maximum – reflects fixed pay, maximum bonus (100% of salary) and maximum LTIP awards, assuming the proposed Policy is approved (i.e. 150% of salary for the CEO and FD).

- Maximum plus share price growth – as for Maximum above, but with the value of 50% share price growth included within the LTIP element

Approach to remuneration for recruitment of a new Executive Director

On the appointment of any new Executive Director, the Committee would seek to offer a remuneration package which can secure an individual with the necessary skills and experience to lead the business and deliver the strategy.

Executive Directors would be appointed within the remuneration framework set out in the Policy Table for Executive Directors. Salaries would typically be set at an appropriately market competitive level to reflect skills and experience, although, if appropriate, the Committee may set salaries towards the lower end of the market range to allow future salary progression to reflect performance in the role. In accordance with the Policy Table, the Committee also has discretion to include other benefits such as housing or relocation benefits, if relevant to reflect specific individual circumstances. The maximum level of variable remuneration which may be awarded (excluding any compensatory awards referred to below) would be as set out in the Policy Table.

Where an individual forfeits outstanding incentive awards with a previous employer, the Committee may offer compensatory awards to facilitate recruitment. These awards would be in such form as the Committee considers appropriate, taking into account all relevant factors including the form, expected value, anticipated vesting and timing of the forfeited awards. The value of any compensatory awards would be no higher, in the opinion of the Committee, than the value forfeited. While cash may be included in the recruitment package to reflect the forfeiture of cash-based incentive awards, the Committee does not envisage that substantial “golden hello” cash payments would be offered.

Any share awards referred to in this section will be granted as far as possible under the Company’s existing share plans. Share awards may be granted under the Company’s LTIP in excess of the limits set out in the Policy Table above to provide compensatory buyout awards only (which may be subject to any performance conditions the Committee considers appropriate), in accordance with the terms above. If necessary, awards may be granted outside of these plans as currently permitted under the Listing Rules, but within the limits set out in this section.

The remuneration package for a newly appointed Non-Executive Director would normally be in line with the structure set out in the Policy Table for Non-Executive Directors

Service contracts

The service agreements of the Executive Directors are rolling contracts which were entered into on the dates shown in the table below:

| Name | Contract Date | Notice period from the Director | Notice period from the Company |

| John Tutte | 01/04/19 | 12 months | 12 months |

| Barbara Richmond | 18/01/10 | 6 months | 12 months |

| Matthew Pratt | 01/07/20 | 6 months | 6 months |

The service agreements provide for formal notice to be served to terminate the agreement, by either the Company or the Executive Director, with the required period of notice shown in the table. The agreements and letters of appointment do not include any provisions for pre-determined compensation for early termination. The Committee may terminate service agreements immediately by making a payment in lieu of notice consisting of base salary, benefits and pension for the unexpired period of notice. At the discretion of the Committee, this payment may be made as instalments over the period, subject to a duty to mitigate, or as a lump sum.

For appointments after 1 July 2017, it is the Committee’s policy that notice periods will normally be 6 months from both the Director and the Company initially and thereafter, 12 months from both the Director and the Company, and that payments in lieu of notice will comprise no more than base salary, benefits and pension only over the unexpired period of notice. This policy applies to Matthew Pratt who was appointed to the Board on 1 April 2019.

The Non-Executive Directors’ terms of appointment are detailed in formal letters of appointment as shown in the table below. Each appointment is for a fixed initial period of three years although this term is terminable upon either party giving three months’ notice.

| Name | Position | Date of initial appointment | Current date of appointment |

| Nick Hewson | Non-Executive | 01/12/12 | 01/12/18 |

| Sir Michael Lyons | Non-Executive | 06/01/15 | 06/01/18 |

| Vanda Murray* | Non-Executive | 01/08/17 | 01/08/20 |

| Nicky Dulieu | Non-Executive | 06/11/19 | 06/11/19 |

* Vanda Murray's appointment was extended on 1 August 2020 to cover the period from this date until the 2020 AGM, at which point she will be retiring from the Board.

Copies of the Directors' service contracts and letters of appointment are available for inspection at the Company's registered office.

Policy on payments following Directors’ termination of service

On termination of a Director’s contract, the Committee’s objective is to agree an outcome which is in the best interests of the Company and its shareholders, taking into account the specific circumstances and performance of the individual, as well as any relevant contractual obligations and incentive plan rules.

As described in the section above, contractual payments in lieu of notice would be limited to salary and contractual benefits and may be made in instalments subject to mitigation.

The Committee has discretion to make a payment under the annual bonus in respect of the year of leaving where an individual is designated a “good leaver” (as described below). In such circumstances, the maximum bonus opportunity would normally be reduced pro-rata to reflect the portion of the year served. Any payment would remain subject to performance against the original targets and, if practicable, would be assessed and paid (in cash) as part of the normal year end assessment process. Outstanding awards under the deferred bonus plan and the LTIP would be treated in accordance with the relevant plan rules. Under these rules, if the participant leaves as a “good leaver”, then the treatment of outstanding awards will be as follows:

- Deferred bonus: Nil-cost options will be exercisable for a period of six months following the date of cessation. Options will be exercisable in full unless (for awards made in respect of 2015 and subsequent financial years other than in the case of death) the Committee exercises discretion to reduce the awards pro-rata to reflect the extent to which the vesting period had elapsed at the date of cessation; and

- LTIP: Awards will normally continue to the original vesting date although the Committee may determine that awards vest following cessation. Where a holding period applies, awards will normally continue to be subject to that holding period following cessation. Unless the Committee determines otherwise, awards will be reduced pro-rata to reflect the extent to which the performance period has elapsed at the date of cessation and time served as an executive. The Committee will decide the extent to which the award vests in these circumstances, taking account of the extent to which the performance condition is satisfied and time served as an executive. If an individual dies, their LTIP awards will normally vest shortly following their death and their LTIP awards will only be time pro-rated if the Committee considers it appropriate.

Circumstances in which a participant will be considered a “good leaver” are: death, ill-health, injury, disability, redundancy, retirement or the sale of the individual’s employing company or business outside of the Group.

Where an individual leaves the Company for any other reason, deferred bonus and unvested LTIP awards will lapse.

The Committee retains discretion to make additional exit payments where such payments are made in good faith in discharge of an existing legal obligation (or by way of damages for breach of such an obligation) or by way of settlement or compromise of any claim arising in connection with the termination of a director’s office or employment or for any fees for outplacement assistance and/or the director’s legal and/or professional advice fees in connection with their cessation of office or employment. The details and rationale for any such payments would be disclosed in the Annual Remuneration Report.

Non-executive director fees

Policy Table for the Non-Executive Directors

Approach of the Company

Fees are determined by the Board excluding the Non-Executive Directors. The fee encompasses a basic fee and supplementary fees for serving on a Board Committee or acting as Senior Independent Director. It may also include supplementary fees for undertaking duties or making a time commitment to Company business beyond the Non-Executive Director’s normal role.

Expenses incurred in respect of the performance of duties for the Company may be reimbursed or paid for by the Company, including any tax due on such payments.

The fees payable to the Non-Executive Directors will not exceed the limit set out in the Company’s Articles of Association and will be set at a level which reflects skills, experience, time commitment and appropriate market data.

Annual Remuneration Report

Statement of Implementation for 2021

This section summarises how the Committee intends to operate the Remuneration Policy for the year ending 30 June 2021.

Salary

The Committee’s policy on salary increases, as set out in the Remuneration Policy, is that they should normally be in line with increases for employees within the business. This approach has been applied consistently by the Committee over a number of years.

Given the circumstances the Company has not awarded a company-wide pay increase this year and therefore, Barbara Richmond’s salary remains unchanged from 1 July 2020.

It had been intended that John Tutte would move to Non-Executive Chairman from 1 July 2020. However, due to the impact of the Covid-19 pandemic on the business, the Board asked John to remain as Executive Chairman until the November 2020 AGM to support the senior management team which he has agreed to do. In line with the company-wide pay freeze, John did not receive an increase to his salary from 1 July 2020.

At the start of the pandemic, the entire directorate volunteered to take a 20% cut in salary and pensions, John Tutte has volunteered to continue his voluntary reduction of 20% of salary until he steps back to Non-Executive Chairman at the November 2020 AGM and therefore his annual rate of salary will be equivalent to £488,000.

Having joined the Main Board as Chief Operating Officer in April 2019, Matthew Pratt took up the position of Group Chief Executive on 1 July 2020. The Remuneration Committee considered carefully how to position Matthew's base salary and felt a phased approach was more appropriate to allow Matthew to gain experience and develop into the role and to reflect John Tutte continuing in an executive capacity until the November 2020 AGM. Therefore, Matthew's salary has initially been set significantly below market levels for the first year at £540,000 and the Remuneration Committee intends to increase this to £625,000 from 1 July 2021 subject to performance. The Committee believes this is an appropriate salary for the following reasons:

- It reflects the level of responsibility and scope of the full role in a challenging market;

- The Redrow Nominations Committee undertook a comprehensive internal and external search and it became clear that top leadership talent with home construction knowledge is relatively scarce. This has been reflected in the level of starting salaries for CEOs with sector experience at other comparable listed housebuilders (where joining salaries have been higher than £625,000);

- The £625,000 salary is subject to performance and, if appropriate, would apply from July 2021 (noting it is a 2.5% increase on John Tutte's which was agreed in July 2019);

- As a sense check, the Remuneration Committee benchmarked the role and took comfort that a £625,000 salary is not excessive against comparable home construction peers and FTSE 250 companies;

- The Remuneration Committee consulted with leading shareholders who appeared supportive of the phased approach to Matthew's salary and the salary positioning; and

- The value of Matthew's total pay package value remains modest against market levels.

The salaries for 2021 are effective from 1 July 2020 and are as follows:

| £'000 |

1 July 2020 |

1 July 2019 |

Change |

| John Tutte* | 488 | 610 | (20%) |

| Barbara Richmond | 370 | 370 |

0% |

| Matthew Pratt** | 540 | - | n/a |

* John Tutte’s salary reflects the continuation of his voluntary 20% reduction

** Matthew Pratt’s role as COO prior to 1 July 2020 is not directly comparable with his position as Chief Executive

Pension

John Tutte and Barbara Richmond will continue to receive a contribution towards pension of 20% of salary.

On appointment to the main Board on 1st April 2019, Matthew Pratt’s pension contribution was agreed at a lower rate of 10% of salary which was a reduction from his previous package which carried a contribution of 15%. On his appointment to Group Chief Executive on 1 July 2020 his pension contribution was further reduced to 7% of salary which is line with the majority of the workforce.

As part of the rolling over of the 2017 policy, a firm commitment has been provided for all executive directors to be aligned with the workforce rate of 7% of salary from 1 July 2023 which aligns with the Company's year end.

Annual Bonus

The annual bonus opportunity will remain at 100% of salary in line with our Policy. John Tutte will not participate in the annual bonus scheme in 2020/21.

The Committee has decided to make changes to the measures that will apply for 2020/21 to reflect the challenging environment. Consistent with last year, 50% of the bonus will be based on PBT targets. To support our aim of delivering sales volumes in a difficult market, 24% of the bonus will be based on revenue.

Customer service remains of paramount importance as does the health and safety of our employees and subcontractors. Accordingly, 14% of the bonus will be based on customer service targets and 12% on health and safety underpinned by Covid-19 compliance on our sites.

| Measures | 2020 |

| Profit Before Tax | 50% |

| Turnover | 24% |

| Customer Service | 14% |

| Health & Safety | 12% |

These revised measures are felt to be more appropriately aligned with our current priorities as we seek to return to growth following the shock to our core business in 2020.

It is the current intention that the targets will be disclosed in the FY 2021 Remuneration Report provided the Committee is comfortable they are no longer commercially sensitive at the time.

LTIP awards to be granted during 2021

It is expected that LTIP awards in the 2021 financial year will be made at the level of 150% of salary to Matthew Pratt and Barbara Richmond. John Tutte will not participate in the 2021 LTIP.

Setting meaningful LTIP targets at the current time is challenging given the uncertainty surrounding COVID-19 and the economic outlook. Therefore, the Remuneration Committee intends to grant LTIP awards at the normal time, in September 2020, and set the measures and targets within six months of grant when there should hopefully be more visibility on the medium term outlook. The measures and targets will be communicated to shareholders at the time they have been agreed and communicated with participants and there will be full disclosure in next year’s Remuneration Report. The level of challenge associated with these targets will take into account the business outlook at the time.

The Remuneration Committee has discretion to adjust the number of shares vesting from the award if it considers that vesting outcome is not sufficiently reflective of the underlying performance of the Company and to the extent the Committee believes there have been windfall gains.

In line with our Policy, these awards will be subject to an additional two-year post-vesting holding period.

Non-Executive Director Fees

The base fee for a Non-Executive Director remains unchanged at £55k p.a. The Company pays an additional fee of £10k p.a. to Committee Chairs and an additional fee of £10k p.a. to the Senior Independent Director. On his appointment as Non-Executive Chairman, John Tutte will receive a fee equivalent to £300k p.a. which is consistent with that granted to our previous Non-Executive Chairman and is reflective of John Tutte’s likely higher than typical expected time commitments during FY 2021 as the Company emerges from a difficult year. The Remuneration Committee believes this fee positioning is appropriate given John’s likely degree of involvement in the business and it is expected that a market-aligned fee rate will apply to John’s successor as Non-Executive Chairman.

Outcomes in Respect of 2020

The tables below set out the remuneration for the Directors in respect of 2020. Further discussion of each of the components is set out on the pages which follow. Where indicated, these disclosures have been audited.

Single Total Figure of Remuneration Table (Audited)

The remuneration of the Executive Directors in respect of 2020 is shown in the table below (with the prior year comparative):

| Salary | Benefits (iii) | Pensions (v) |

Total fixed remuneration |

Bonus (vi) | LTIP (vii) |

Total variable remuneration |

Total | |||||||||

| £'000 | 2020 | 2019 |

2020 |

2019 |

2020 | 2019 | 2020 | 2019 |

2020 |

2019 |

2020 | 2019 |

2020 |

2019 |

2020 |

2019 |

| John Tutte (i) | 580 | 598 | 16 | 16 | 116 | 120 | 712 | 734 | - | 508 | - | 851 | - | 1,359 | 712 | 2,093 |

| Barbara Richmond | 360 | 338 | 35 | 19 | 72 | 68 | 467 | 425 | - | 287 | - | 481 | - | 768 | 467 | 1,193 |

| Matthew Pratt (ii) | 399 | 103 | 22 | 5 | 40 | 10 | 461 | 118 | - | 87 | - | 184 | - | 271 | 461 | 389 |

(i) John Tutte served as Chief Executive Officer until 1 April 2019 when he became Executive Chairman.

(ii) Executive Directors took a voluntary 20% salary and pension deduction from 1 April 2020 to 18 May 2020 with John Tutte maintaining the deduction throughout his remaining period as Executive Chairman.

(iii) Matthew Pratt was appointed to the Board as Chief Operating Officer on 1 April 2019. His FY 2019 remuneration relates to his period on the Board except for the 2019 LTIP value which is in relation to the award he was granted in September 2016 when he was not on the Board.

(iv) Benefits include a fully expensed company car (or equivalent cash allowance) and private health insurance.

(v) Pension includes the value of the cash allowance paid to John Tutte, Barbara Richmond and Matthew Pratt in respect of the relevant year.

(vi) Annual bonus represents the full value of the bonus awarded in respect of the relevant financial year. Details of performance targets are set out below. Half of the 2019 bonus was deferred into Redrow shares, which vests in two tranches of 50% each, on the first and second anniversaries of the grant date, subject to continued employment.

(vii) LTIP represents the value of the LTIP award which vests in respect of the 3-year performance period ending in the relevant financial year. No shares will vest on 15 November 2020 due to the vesting threshold not being reached. The 2019 column includes an updated vested value for the 2016 LTIP award (which vested at 100% of maximum), based on the share price on the actual date of vesting (12 September 2019). The figure provided last year was based on the average share price over the last three months of the FY2019 financial year.

The fees of the Non-Executive Directors in respect of 2020 are shown in the table below (with the prior year comparative).

| Fees | ||

| £'000 | 2020 | 2019 |

| Steve Morgan (i) | - | 7 |

| Debbie Hewitt (ii) | - | 26 |

| Nick Hewson | 73 | 72 |

| Sir Michael Lyons | 63 | 65 |

| Vanda Murray | 63 | 61 |

|

Nicky Dulieu (iii) |

35 | - |

| (i) Steve Morgan served as Non-Executive Chairman from 1 July 2018 until his retirement from the Board on 31 March 2019. The disclosure in this table and footnote are in reference to that period. Steve Morgan drew a nominal fee of £10k per annum which he donated via Payroll Giving to The Steve Morgan Foundation, a UK registered charity of which Steve Morgan is a trustee. The Company also made a donation in 2019 to The Steve Morgan Foundation of £218k (being the balance for this period of Steve Morgan’s notional annual fee of £300k per annum less the £10 nominal fee). | ||

| (ii) Debbie Hewitt retired as a Non-Executive Director on 7 November 2018. | ||

|

(iii) Nicky Dulieu was appointed as Non-Executive Director on 6 November 2019. |

||

2020 Annual bonus

The maximum bonus opportunity for the Executive Directors during 2020 was 100% of salary, in line with the Remuneration Policy. This was based on the achievement of stretching targets under a balanced scorecard of six key performance measures. The scorecard combined measures which represent an appropriate balance between ‘backward looking’ financial performance (PBT) ‘forward looking’ strategic and operational measures (order book and land holdings) which support shareholder value creation over the medium to long-term together with building responsibly measures (customer recommend score and accident rate) and personal objectives.

| % of bonus opportunity | Rationale | |

| PBT | 50% | A fundamental measure of annual profitability |

| Closing private order book | 10% | A measure of how effectively we are protecting future performance |

| Land holdings acquired | 10% | Measures the foundation for our future growth |

| Customer recommend score | 30% | Measure of customer satisfaction |

| Accident rate | 5% |

Focus on building safely |

|

Personal objectives |

10% | Covering strategic, operational and people objectives |

The 2020 targets and outcomes are disclosed in the following table:

| 2020 Target Range | |||||

|

% of bonus opportunity |

Threshold payout (10% of maximum) |

Maximum payout |

Actual 2020 performance |

Payout achieved (% of total bonus opportunity) |

|

| PBT | 50% | £395m | £435m |

£140m |

- |

| Order book | 10% | £650m | £720m | £1,135m | 10% |

| GDV of land acquired | 10% | £2.05bn | £2.25bn | £1.5bn | - |

|

Customer recommend score |

15% | 90% | 92.5% | 91.8% | 12.9% |

| Accident rate | 5% | Homes built/accidents >15 | 16.62 | 5% | |

| Personal objectives | 10% |

|

Achieved - see below | 10% | |

| Total | 100% | 37.9% | |||

Personal objectives for each Executive Director were divided into three equally weighted measures, categorised under the headings Strategic, Operational and People. For FY 2020, the Strategic measure was common to all three Executive Directors and was focused on a forward-looking strategic plan to mitigate potential changes to the Help to Buy scheme. The Operational measure was targeted on delivering a more even spread of completions throughout the year. The People measure was based on talent management and succession planning activities in each Executives' respective area of the business. Commercial sensitivities remain around the specific targets but in all cases the Committee assessed performance using a combination of quantitative and qualitative information and was satisfied that the targets had been met in full.

Whilst some of the non-profit related measures were achieved (which would have resulted in a 37.9% payout under the scheme), the Executive Directors, having reflected on the impact on Redrow’s wider stakeholders, advised the Committee during the financial year that they wished to forego voluntarily any bonus for the year. The Remuneration Committee is supportive of this wish and therefore no bonuses will be awarded this year.

Long Term Incentive Plan (LTIP)

The LTIP is designed to motivate and reward long-term performance and delivery of the strategy and provide alignment with Redrow shareholders.

The sections below summarise details of the LTIP awards which vested in respect of 2020 (2017 awards) and which were granted during the 2020 financial year.

LTIP awards vesting in respect of 2020

The LTIP awards granted in November 2017 were based on performance over the three year performance period ending 28 June 2020. Based on performance against the EPS and ROCE targets set when the award was granted, summarised in the table following, neither of the thresholds were met and therefore these awards will lapse on 15 November 2020.

| Award vesting level as a % of share options granted (for each component) | EPS for 2020* | ROCE for 2020 |

| Nil | Below 84.42p | Below 24.2% |

| 6.67% | 84.42p | 24.2% |

| 20% | 94.92p | 25.7% |

| 50% | 109.62p or above | 27.2% or above |

|

Vesting between the points above is on a sliding scale basis |

||

| Actual performance | 32.9p | 9.2% |

| Vesting (% of total award) | nil% | nil% |

| * As outlined in the Cash Return Circular published in 2019 an upwards adjustment of the EPS performance target was necessary to neutralise the effect of the return of cash and share consolidation which took place in 2019. | ||

As no shares vested the value of these awards is nil and has been included in the 2020 LTIP column of the Single Total Figure of Remuneration Table on page 91.

Scheme Interests Awarded During 2020 (Audited)

The following table sets out details of LTIP awards to Executive Directors during the 2020 financial year.

| Executive Director | Number of awards granted | Basis of award | Face value* |

Threshold vesting (% of maximum) |

Vesting date |

| John Tutte |

153,911 |

150% of salary |

£915k |

13.3% | September 2022 |

| Barbara Richmond |

93,356 |

150% of salary | £555k | 13.3% | September 2022 |

| Matthew Pratt |

103,448 |

150% of salary | £615k |

13.3% |

September 2022 |

* The face value has been calculated using the average share price used to determine the number of shares awarded, being 594.5p (the average, over the three days to the date of grant).

Awards to John Tutte, Matthew Pratt and Barbara Richmond are made in the form of nil-cost options.

The LTIP awards granted on 11 September 2019 will vest in September 2022 based on performance over the three-year performance period ending 30 June 2022 as follows:

|

Award vesting level as a % of share options granted (for each component) |

EPS for 2022 | ROCE for 2022 |

| Nil | Below 105.0p | Below 23.4% |

| 6.67% | 105.0p | 23.4% |

| 20% | 110.0p | 24.4% |

| 50% | 115.0p or above | 25.4% or above |

| Vesting between the points above is on a sliding scale basis. The target range was set in light of the business outlook at the time including internal forecasts, external analyst consensus and a broader view of the macroeconomic environment. | ||

Deferred Bonus Plan awards, being 50% of the bonus earned relating to FY2019 performance, were granted during the year as set out below:

| Executive Director |

Number of awards granted |

Face value* |

Portion of bonus deferred |

Vesting date |

| John Tutte |

42,750 |

£254k |

50% |

50% in September 2020 and 50% in September 2021 |

| Barbara Richmond | 24,163 | £144k | 50% | 50% in September 2020 and 50% in September 2021 |

| Matthew Pratt |

25,471 |

£151k | 50% |

50% in September 2020 and 50% in September 2021 |

* The face value has been calculated using the average share price used to determine the number of shares awarded, being 594.5p (the average over the three days to the date of grant).

Shareholding guidelines and share interests

Under our shareholding guidelines, Executive Directors are expected to build and retain a shareholding in the Group at least equivalent to 200% of base salary. Until the shareholding guideline has been met Executives will be required to retain all deferred bonus shares and LTIP shares on a net of tax basis. As shown in the table below, John Tutte and Barbara Richmond meet this guideline.

*Matthew Pratt is building his shareholding in line with the Remuneration Policy and held at 61% of salary as at 28 June 2020. As noted above, Matthew is expected to retain all Deferred Bonus Plan and LTIP shares on a net of tax basis until the shareholding guideline is met. Non-Executive Directors are not subject to shareholding guidelines.

Statement of Shareholding and Scheme Interests (Audited)

The following table sets out the shareholding (including connected persons) of the Directors in the Company as at 28 June 2020 and current interests in long-term incentives.

|

Number of shares beneficially held at 28 June 2020 |

Shareholding as % of salary |

Guideline met? | |

| Executive Directors | |||

| John Tutte | 755,686 | 699% | Yes |

| Matthew Pratt | 73,020 | 61% |

No* |

| Barbara Richmond | 542,332 | 662% |

Yes |

| Non-Executive Directors | |||

| Nick Hewson | 19,523 | ||

| Sir Michael Lyons |

2,857 |

||

| Vanda Murray | 3,333 | ||

| Nicky Dulieu | - |

Shareholding as a percentage of salary is calculated using the shareholding and base salary as at 1 July 2020 and the average share price for the final quarter of the 52 weeks ended 28 June 2020.

The table below provides details of the interests of the Executive Directors in incentive awards during the year.

|

Awards held at 30 June 2019 |

Grant Date |

Share Price on Grant £ |

Award Vested |

Awards granted in year |

Awards Excercised in year |

Awards held at 28 June 2020 |

Excercise Price £ |

From | To | |

| John Tutte | ||||||||||

| SAYE 2017 | 3,673 | 30/10/17 | 6.12 | - | - | - | 3,673 | 4.90 | 01/01/21 | 01/07/21 |

| LTIP 2016 | 138,882 | 12/09/16 | 4.097 |

138,882 |

- |

(138,882) |

- | 12/09/19 | 12/09/26 | |

| LTIP 2017 | 147,346 | 15/11/17 | 5.935 | - | - | - | 147,346 | 15/11/20 | 15/11/27 | |

| LTIP 2018 | 152,370 | 10/09/18 |

5.887 |

- |

- |

- | 152,370 | 10/09/21 | 10/09/28 | |

| LTIP 2019 | - | 11/09/19 | 5.945 | - | 153,911 | - | 153,911 | 11/09/22 | 11/09/29 | |

| DEF BONUS 2017 | 22,579 | 11/09/17 | 6.30 |

22,579 |

- |

(22,579) |

- | 11/09/18 | 11/09/27 | |

| DEF BONUS 2018 |

47,923 |

10/09/18 |

5.887 |

23,961 |

|

(23,961) |

23,962 |

10/09/19 | 10/09/28 | |

| DEF BONUS 2019 | - | 11/09/19 | 5.945 | - | 42,750 | - | 42,750 | 11/09/20 | 11/09/29 | |

|

512,773 |

185,422 |

196,661 |

(185,422) |

524,012 |

|

Awards held at 30 June 2019 |

Grant Date |

Share Price on Grant £ |

Award Vested |

Awards granted in year |

Awards Excercised in year |

Awards held at 28 June 2020 |

Excercise Price £ |

From | To | |

| Barbara Richmond | ||||||||||

| SAYE 2016 | 2,812 | 28/10/16 | 4.00 | 2,812 | - | (2,812) | - | 3.20 | 01/01/20 | 01/07/20 |

| SAYE 2017 | 1,836 | 30/10/17 | 6.12 | - | - | - | 1,836 | 4.90 | 01/01/21 | 01/07/21 |

| SAYE 2019 | 1,821 | 28/10/19 | 6.18 | - | - | - | 1,821 | 4.94 | 01/01/23 | 01/07/23 |

| LTIP 2016 | 78,472 | 12/09/16 | 4.097 | 78,472 | - | (36,975) | 41,497 | 12/09/19 | 12/09/26 | |

| LTIP 2017 | 83,404 | 15/11/17 | 5.935 | - | - | - | 83,404 | 15/11/20 | 15/11/27 | |

| LTIP 2018 | 86,122 | 10/09/18 | 5.887 | - | - | - | 86,122 | 10/09/21 | 10/09/28 | |

| LTIP 2019 | - | 11/09/19 | 5.945 | - | 93,356 | - | 93,356 | 11/09/22 | 11/09/29 | |

| DEF BONUS 2017 | 12,758 | 11/09/17 | 6.30 | 12,758 | - | (12,758) | - | 11/09/18 | 11/09/27 | |

| DEF BONUS 2018 | 27,062 | 10/09/18 | 5.887 | 13,531 | - | (13,531) | 13,531 | 10/09/19 | 10/09/28 | |

| DEF BONUS 2019 | - | 11/09/19 | 5.945 | - | 24,163 | - | 24,163 | 11/09/20 | 11/09/29 | |

| 274,632 | 107,573 | 117,519 | (66,076) | 345,730 |

|

Awards held at 30 June 2019 |

Grant Date |

Share Price on Grant £ |

Award Vested |

Awards granted in year |

Awards Excercised in year |

Awards held at 28 June 2020 |

Excercise Price £ |

From | To | |

| Matthew Pratt | ||||||||||

| SAYE 2017 | 3,673 | 30/10/17 | 6.12 | - | - | - | 3,673 | 4.90 | 01/01/21 | 01/07/21 |

| LTIP 2016 | 30,022 | 12/09/16 | 4.097 | 30,022 | - | (14,146) | 15,876 | 12/09/19 | 12/09/26 | |

| LTIP 2017 | 23,168 | 15/11/17 | 5.935 | - | - | - | 23,168 | 15/11/20 | 15/11/27 | |

|

LTIP 2018 |

23,951 | 10/09/18 | 5.887 | - | - | - | 23,951 | 10/09/21 | 10/09/28 | |

| LTIP 2019 | - | 11/09/19 | 5.945 | - | 103,448 | - | 103,448 | 11/09/22 | 11/09/29 | |

| DEF BONUS 2017 | 11,846 | 11/09/17 | 6.30 | 11,846 | - | (11,846) | - | 11/09/18 | 11/09/27 | |

| DEF BONUS 2018 | 27,858 | 10/09/18 | 5.887 | 13,929 | - | (13,929) | 13,929 | 10/09/19 | 10/09/28 | |

| DEF BONUS 2019 | - | 11/09/19 | 5.945 | - | 25,471 | - | 25,471 | 11/09/20 | 11/09/29 | |

| 120,518 | 55,797 | 128,919 | (39,921) | 209,516 |

(i) The performance conditions attached to the 2018 LTIP awards were disclosed in the 2019 Directors’ Remuneration Report.

(ii) The performance conditions attached to the 2019 LTIP awards are shown on page 93.

(ii) There are no further performance conditions attached to the exercise of the deferred bonus awards.

(iv) Between 29 June 2020 and 15 September 2020 (being the latest practicable date prior to the posting of this report), there were no further changes to the directors’ interests set out in the Statement of shareholding and scheme interests above.

As noted on page 74 of the 2019 Annual Report, 108,961 LTIP share options granted in September 2016 to Steve Morgan vested on 12 September 2019 and were paid in cash as per the scheme rules.

Gains made by Directors on Share Options

The table below outlines the notional gains made by Directors on share options exercised during the year, calculated as at the exercise date.

| Executive Director | Scheme |

No. shares exercised |

Date of exercise |

Mid price on date of exercise (pence) |

Notional gain on exercise (£'000) |

| John Tutte | LTIP 2016 | 138,882 | 12/09/19 | 612.00 | 849.96 |

| DEF Bonus 2017 | 22,579 |

11/09/19 |

604.50 | 136.49 | |

| DEF Bonus 2018 | 23,961 |

11/10/19 |

595.83 | 142.77 | |

| 185,422 | 1,129.22 | ||||

| Barbara Richmond | LTIP 2016 | 36,975 | 12/09/19 |

612.00 |

226.29 |

| DEF Bonus 2017 | 12,758 |

11/09/19 |

604.50 |

77.12 | |

| DEF Bonus 2018 | 13,531 |

10/09/19 |

595.83 |

80.62 | |

| 63,264 | 384.03 | ||||

| Matthew Pratt |

LTIP 2016 |

14,146 | 12/09/19 |

612.00 |

86.57 |

|

DEF Bonus 2017 |

11,846 | 11/09/19 | 604.50 | 71.61 | |

| DEF Bonus 2018 | 13,929 | 10/09/19 |

595.83 |

82.99 | |

| 39,921 | 241.17 |

Pension

John Tutte and Matthew Pratt are deferred members of the Redrow Staff Pension Scheme (now closed to future accrual) and details of entitlements under this plan are set out below. He also received a pension allowance supplement of 20% of salary. Barbara Richmond received a pension allowance supplement equivalent to 20% of salary and Matthew Pratt received a contribution of 10% of salary. The value of these cash supplements is included in the pension column of the Single Total Figure of Remuneration Table on page 91. John Tutte, Barbara Richmond and Matthew Pratt are also covered by fixed term group income protection and death in service benefit.

Total Pension Entitlements (Audited)

Details of the Executive Directors’ pension entitlements under the defined benefit section of the Redrow Staff Pension Scheme are as follows:

| Director | Normal retirement date |

Accrued benefit at 28 June 2020 £ |

Benefits paid to Director during period up to 28 June 2020 £ |

Defined Benefit accrued during period up to 28 June 2020 £ |

| John Tutte | 24 June 2021 | 57,919 | Nil | Nil |

| Matthew Pratt | 6 July 2040 | 15,373 | Nil | Nil |

The normal retirement date shows the date at which the Director can retire without actuarial reduction. No additional benefit is available on early retirement.

The accrued pension shown above is the amount of pension entitlement that would be paid each year on retirement on the normal retirement date, based on service to 29 February 2012. The Scheme closed the accrual of future benefits with effect from 1 March 2012.

Supporting Disclosures and Additional Context

Percentage change in remuneration of Executive Chairman

The table below shows the percentage change in the salary, benefits and annual bonus of the Executive Chairman and of all Redrow employees who qualify for participation in the Company’s bonus and benefits plans between 2019 and 2020.

|

Executive Chairman |

All Redrow employees |

|

| Salary | 2.0% | 2.92% |

| Benefits | Nil% | 11.0% |

| Annual bonus | (100%) | (64.3%) |

Additional Statutory Information

|

Matthew Pratt (Chief Operating Officer during FY 2020) |

Barbara Richmond (Chief Financial Officer) |

Nick Hewson (Senior Independent Director) |

Vanda Murray (Non-Executive Director) |

Sir Michael Lyons (Non-Executive Director) |

Nicky Delieu (Non-Executive Director) |

|

| Salary |

Matthew Pratt was appointed to the Board as Chief Operating Officer on 1 April 2019* |

6.50% | 1.40% | 3.30% | -3.00% |

Nicky Delieu was appointed as Non-Executive Director on 6 November 2019* |

| Benefits | 84.2%** | n/a | n/a | n/a | ||

| Annual bonus | -100% | n/a | n/a | n/a |

* A year-on-year comparison is not possible in these circumstances

** This increase from £19k to £35k was in relation to a change in company car and the provision of fuel.

CEO Pay Ratio

| CEO Pay Ratio | Method A |

| 25th Percentile pay ratio | 27:1 |

| 50th Percentile pay ratio | 18:1 |

| 75th Percentile pay ratio | 12:1 |

The remuneration figures for the employee at each quartile were determined with reference to 28 June 2020.

Our CEO pay ratios have been calculated using Option A under the Companies (Miscellaneous Reports) Regulations 2018 as this is the most statistically accurate way. The total remuneration of all UK employees for the 2020 financial year has been calculated and ranked to identify the employees where remuneration places them at the 25th, 50th and 75th percentile points.

The total pay and benefits and salary of the employees paid at the 25th percentile, 50th percentile and 75th percentile is shown below.

|

25th Percentile |

50th Percentile |

75th Percentile** |

|

| Salary | £23,950 | £32,008 | £27,760 |

| Total pay and benefits | £26,069 | £40,581 | £60,756 |

*The pay ratio comparison has been calculated on using John Tutte’s single total figure remuneration as Executive Chairman as this is considered the most appropriate position.

** The employee identified at the 75th percentile is in a sales consultant role, which has the opportunity to earn higher remuneration through commission arrangements, hence the base salary is lower than the 50th percentile employee but total pay and benefits is higher

The Remuneration Committee notes that the Executive Chairman’s remuneration package is appropriately more heavily weighted toward variable pay elements, i.e. annual bonus and LTIP, than the general employee population and is therefore likely to result in the ratio fluctuating as a function of the outcomes of incentive plans year on year. However, the Committee will continue to monitor pay ratios, including any longer term trends, as part of its annual agenda.

Relative importance of spend on pay

The table below shows total employee remuneration and distributions to shareholders, in respect of 2020 and 2019 (and the difference between the two).

| £m | 2020 | 2019 | Change (%) |

| Total employee remuneration | 134 | 141 | (5.0%) |

| Distributions to shareholders | - | 220 | 100% |

Total employee remuneration represents amounts included in note 7a to the accounts in respect of wages, social security, pension and incentive costs for all Group employees. Distributions to shareholders include the cash returns in respect of each financial year (see note 5 to the financial statements). This represents nil pence per share in respect of 2020 compared to 60.5 pence per share in respect of 2019 including the B share cash return.

Performance graph and table

The chart below shows the TSR of Redrow in the ten-year period to 28 June 2020 against the TSR of the FTSE 250. TSR refers to share price growth with re-invested dividends. The Committee believes the FTSE 250 index is the most appropriate index against which the TSR of Redrow should be measured, as it is a constituent of the FTSE 250.

The table below provides remuneration data for the Executive Chairman/Group Chief Executive (as applicable) for each of the nine financial years over the equivalent period.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Name |

Steve Morgan |

Steve Morgan |

Steve Morgan |

Steve Morgan |

John Tutte |

John Tutte |

John Tutte |

John Tutte |

John Tutte |

John Tutte |

| Remuneration/donations* | £582k | £855k | £1,050k | £1,922k | £2,355k | £1,916k | £2,463k | £1,950k | £2,093k | £712k |

| Bonus (% of Maximum) | 50% | 50% | 80% | 100% | 100% | 100% | 100% | 96.7% | 85% | Nil%** |

| LTIP vesting (% of Maximum) | 0% | 0% | 19% | 100% | 100% | 100% | 100% | 100% | 100% | Nil% |

* For Steve Morgan, this value includes the nominal salary and benefits disclosed in the Single Total Figure of Remuneration table as well as Company donations to The Steve Morgan Foundation, a UK registered charity of which Steve Morgan is a trustee, reflecting notional salary and waived annual cash bonus in respect of the relevant year. It also includes the value of deferred bonus and vested LTIP cash awards in respect of each relevant year (calculated in accordance with the methodology applicable to the Single Total Figure of Remuneration Table).

** John Tutte voluntarily waived any bonus for 2020 given the wider stakeholder experience

External non-executive directorships held by Executive Directors

It is the Committee’s policy that, with the approval of the Board, Executive Directors may hold one non-executive directorship at another company in order to broaden their knowledge and experience to the benefit of the Company. The Executive Director may retain any fee received for these duties. Barbara Richmond is a non-executive director of Lonza Group Ltd and in line with the Committee’s policy, she is entitled to retain the fees from this appointment. She received fees of £205k during 2020 (£169k during 2019). This represented 240,000 Swiss Francs in both years.

Consideration of directors’ remuneration – Remuneration Committee and advisors

The Remuneration Committee is comprised solely of Non-Executive Directors and comprises Vanda Murray as Chair, Nick Hewson, Sir Michael Lyons and Nicky Dulieu.

The Committee has agreed Terms of Reference detailing its authority and responsibilities. The Terms of Reference of the Committee are kept under regular review and are published on the Group’s website and include:

- determining the Remuneration Policy in respect of the Executive Directors and the Company Secretary (together ‘the Senior Executives’), taking into account the context of the Company’s overall approach to remuneration for all employees and within this Policy determining the total individual package of each Senior Executive;

- determining performance targets and the extent of their achievement for both annual and long-term incentive awards operated by the Company affecting Senior Executives; and

- monitoring and approving the level and structure of remuneration of the Executive Committee immediately below the Senior Executives.

The Committee meets as often as is required but at least twice per year. The Committee met four times during the course of the financial year ended 28 June 2020 and details of Committee attendance are set out in the following table:

Table of Attendance

| Name | Role | Attendance at Meetings |

| Vanda Murray | Chair* | 4/4 |

| Nick Hewson | Member | 4/4 |

| Sir Michael Lyons | Member | 4/4 |

| Nicky Dulieu |

Member |

4/4 |