1. Our opinion is unmodified

We have audited the financial statements of Redrow plc (“the Company”) for the period ended 27 June 2021 which comprise the Consolidated Income Statement, the Group and Company Statement of Comprehensive Income, the Group and Company Balance Sheets, the Group and Company Statement of Changes in Equity, the Group and Company Statement of Cash Flows, and the related notes, including the accounting policies on pages 180 to 217.

In our opinion:

- the financial statements give a true and fair view of the state of the Group’s and of the parent Company’s affairs as at 27 June2021 and of the Group’s profit for the period then ended;

- the Group financial statements have been properly prepared in accordance with international accounting standards in conformity with the requirements of the Companies Act 2006;

- the parent Company financial statements have been properly prepared in accordance with international accounting standards inconformity with the requirements of, and as applied in accordance with the provisions of, the Companies Act 2006; and

- the financial statements have been prepared in accordance with the requirements of the Companies Act 2006 and, as regards the Group financial statements, Article 4 of the IAS Regulation to the extent applicable.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (“ISAs (UK)”) and applicable law. Our responsibilities are described below. We believe that the audit evidence we have obtained is a sufficient and appropriate basis for our opinion. Our audit opinion is consistent with our report to the audit committee.

We were first appointed as auditor by the directors on 13 November 2019. The period of total uninterrupted engagement is for the two financial periods ended 27 June 2021. We have fulfilled our ethical responsibilities under, and we remain independent of the Group in accordance with, UK ethical requirements including the FRC Ethical Standard as applied to listed public interest entities. No non-audit services prohibited by that standard were provided.

| Overview | ||

| Materiality: | £15.7m (2020: £15.4m) | |

| group financial statements as a whole | 5% (2020: 5%) of group profit before tax | |

| Coverage | 99% (2020: 100%) of group profit before tax | |

| Key audit matters | vs 2020 | |

| Recurring risks | Cost of sales recognition and carrying amount of both land held for development and work in progress | ᐊ ᐅ |

| Valuation of defined benefit obligation (group and company risk) | ᐊ ᐅ | |

2. Key audit matters: our assessment of risks of material misstatement

Key audit matters are those matters that, in our professional judgement, were of most significance in the audit of the financial statements and include the most significant assessed risks of material misstatement (whether or not due to fraud) identified by us, including those which had the greatest effect on: the overall audit strategy; the allocation of resources in the audit; and directing the efforts of the engagement team. We summarise below the key audit matters, in decreasing order of audit significance, in arriving at our audit opinion above, together with our key audit procedures to address those matters and, as required for public interest entities, our results from those procedures. These matters were addressed, and our results are based on procedures undertaken, in the context of, and solely for the purpose of, our audit of the financial statements as a whole, and in forming our opinion thereon, and consequently are incidental to that opinion, and we do not provide a separate opinion on these matters.

| The risk | Our response | |

| Cost of sales recognition and carrying amount of both land held for development and work in progress | Subjective estimates: | |

|

Cost of sales (£1,525 million; 2020: £1,097 million); carrying amount of land held for development (£1,526 million; 2020: £1,538 million) and work in progress (£910 million; 2020: £972 million) Refer to page 110 (Audit Committee Report), page 187 (accounting policy) and page 190 and 209 (financial disclosures). |

The Group holds inventory in the form of land for development, work in progress and showhomes. The amount of cost of sales recognised in the period includes an allocation of whole site costs to each plot sold. Due to development timescales, for certain sites (typically large multi- phased sites or sites with significant infrastructure and development costs still to be incurred, the calculation of whole site costs can include significant estimates of future costs. As a result, for certain sites cost of sales recognised in the year is subject to estimation uncertainty. Infrastructure and development works are often finalised towards the latter stages of the development therefore the level of estimation uncertainty can be significant where the future infrastructure and development requirements are large and complex. The level of estimation uncertainty is higher at the beginning of the development when fewer actual infrastructure and development costs are known. The assessment of recoverability of the carrying amount of work in progress is also dependant on estimates of costs of completion, including future infrastructure and development costs. The carrying value of land not yet in development is assessed based on a number of key assumptions including the likelihood of favourable planning applications and recoverability of pre-development costs. Changes in any of the key assumptions could lead to a material change in the estimation of the carrying value of land for development. The estimates made are profit impacting and therefore there is an incentive for management to manipulate the assumptions made to meet profit targets. The effect of these matters is that as part of our risk assessment we determined that cost of sales and carrying amount of work in progress and land held for development have a high degree of estimation uncertainty, with a potential range of reasonable outcomes greater than our materiality for the financial statements as a whole and possibly many times that amount. The financial statements (note 1) disclose the key judgements and sources of estimation for the Group. |

We performed the tests below rather than seeking to rely on any of the Group’s controls because our knowledge of the design of these controls indicated that we would not be able to obtain the required evidence to support relying on them. Our procedures included: Test of details: For a sample of undeveloped land sites and capitalised pre development costs, we corroborated explanations received from management as to their planning status by assessing underlying planning and legal documents and quantity surveyor assessments where applicable to assess the completeness and accuracy of related net realisable value provisions recorded; For a sample of sites which, due to either their size, complexity or performance or a combination, we considered at higher risk of misstatement we inspected whole site build cost budgets and infrastructure and development budgets and challenged management’s inputs and assumptions by performing the following procedures: Test of details: compared the period end carrying value of work in progress recorded to that determined by the Quantity Surveyor and performed a comparison to the actual costs incurred to verify that any abnormal costs or build variances incurred, have been appropriately identified and accounted for in the period. Test of details: We assessed the accuracy of site build costs and infrastructure and development budgets by selecting a sample of forecast costs included in the budgets and agreeing these to supporting documents such as invoices, quotations and planning obligations; Test of details: We recalculated the cost of sales release with reference in accordance with site build costs and infrastructure and development budgets and compared to the group's calculations; Sector expertise: We used our own Quantity surveyor specialists to challenge areas of risk within the build cost forecasts, particularly in respect of incomplete site-wide infrastructure and development works, to assess whether the risk was appropriately reflected in both forecast costs and cost of sales for sold units. Test of details: For all sites with unit sales during the year, comparing the gross profit margin recognised to the site build cost budgets and infrastructure and development budgets and initial land appraisals and determining whether variances are supportable. Test of details: We identified low and negative margin sites and challenged the completeness and accuracy of the group's related net realisable value provisions recorded in relation to these sites. Test of details: For a sample of sites not considered at higher risk of misstatement, we compared year end positions to valuations performed by internal Quantity Surveyors and assessed the accuracy of infrastructure and development budgets by agreeing a sample of budgeted costs to supporting documents such as invoices, quotations and planning obligations. Historical comparisons: For a sample of sites completed in the year, we performed a retrospective review to compare the overall build cost budget (including infrastructure and development costs) and sales forecasts to actual costs and selling prices achieved to assess the accuracy of site budgets and forecasts. Assessing transparency: Assessing the adequacy of the Group's disclosures about the degree of estimation involved in calculating cost of sales and carrying value of land and work in progress. Our results We consider the cost of sales recognition and the carrying amount of both land held for development and work in progress to be acceptable (2020: acceptable). |

| Valuation of the defined benefit obligation | Subjective estimate: | |

|

Group and Company: (£137 million; 2020: £151 million) Refer to page 110 (Audit Committee Report), page 188 (accounting policy) and pages 198 to 201 and 190 (financial disclosures). |

Changes in the assumptions used to determine the liabilities of The Redrow Staff Pension scheme, in particular those relating to price inflation rate and the discount rate, can have a significant impact on the valuation of the liabilities. The effect of these matters is that, as part of our risk assessment for audit planning purposes, we determined that the valuation of the defined benefit obligation had a high degree of estimation uncertainty, with a potential range of reasonable outcomes close to or greater than our materiality for the financial statements as a whole. In conducting our final audit work, we reassessed the degree of estimation uncertainty to be less than that materiality. |

We performed the tests below rather than seeking to rely on any of the Group’s controls because our knowledge of the design of these controls indicated that we would not be able to obtain the required evidence to support relying on them. Our procedures included: — Use of specialist: We used our actuarial specialists to challenge the key assumptions applied in the calculation of the liability, including those relating to price inflation rate and the discount rate, against externally derived market data. — Assessing actuaries credentials: We assessed the competence, independence, and integrity of Group’s actuarial expert. — Assessing transparency: We considered the adequacy of the Group’s disclosures relating to the sensitivity of the obligation to the assumptions. Our results: The results of our testing were satisfactory and we consider the carrying amount of defined benefit obligation to be acceptable (2020: acceptable). |

We continue to perform procedures over going concern as outlined in section 4 of our report. However, following the recovery of performance of the Group following COVID and increased cash position, we have not assessed this as one of the most significant risks in our current year audit and, therefore, it is not separately identified in our report this year.

3. Our application of materiality and an overview of the scope of our audit

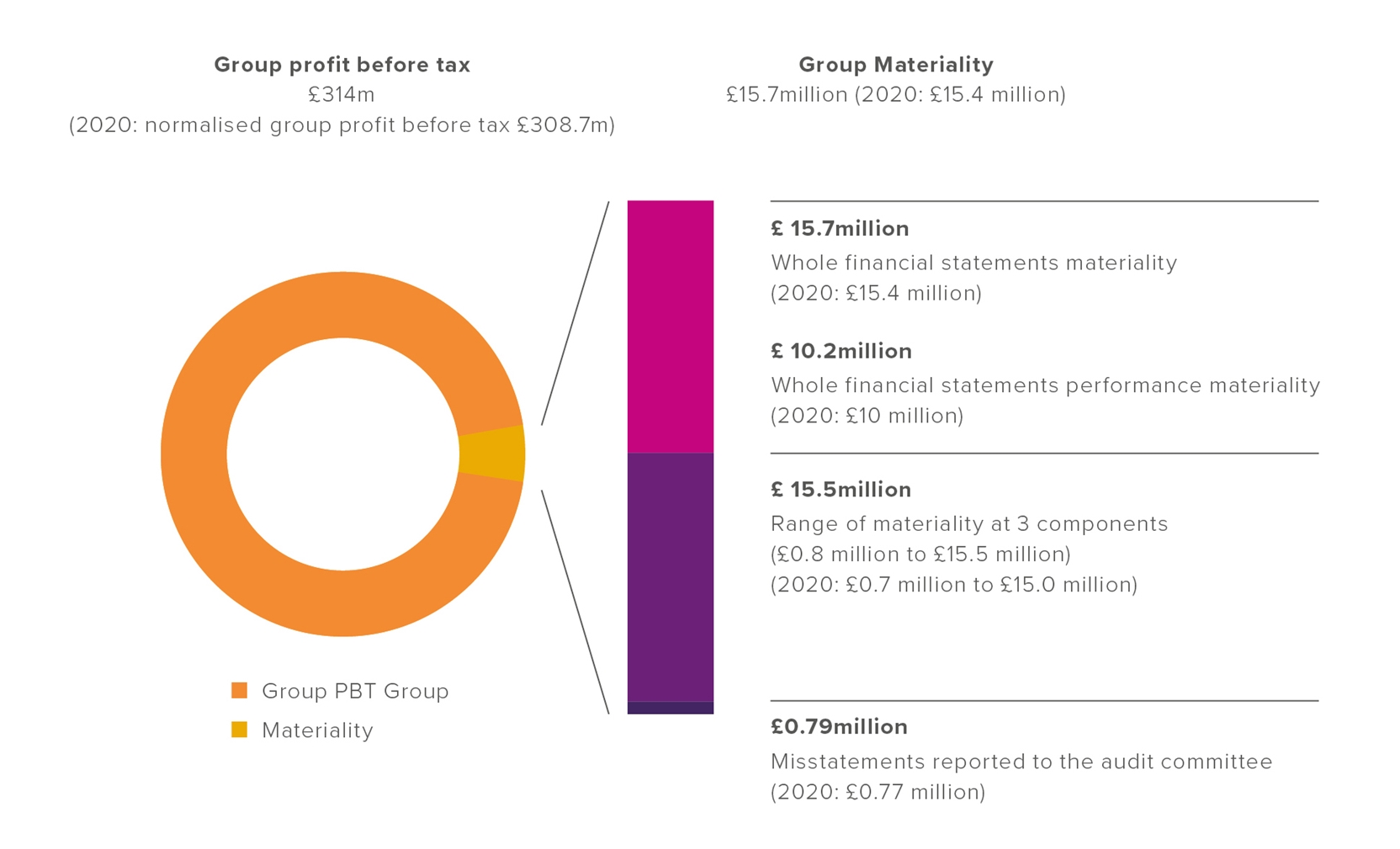

Materiality for the Group financial statements as a whole was set at £15.7 million (2020: £15.4 million) determined with reference to a benchmark of group profit before tax in the period to 27 June 2021 of £314 million (2020: normalised group profit before tax of £308.7 million), of which it represents 5% (2020: 5%).

Materiality for the parent company financial statements as a whole was set at £15.7 million (2020: £15.3 million), determined with reference to a benchmark of net assets, of which it represents 1.7% (2020: 1.6%).

In line with our audit methodology, our procedures on individual account balances and disclosures were performed to a lower threshold, performance materiality, so as to reduce to an acceptable level the risk that individually immaterial misstatements in individual account balances add up to a material amount across the financial statements as a whole.

Performance materiality for the group was set at 65% (2020: 65%) of materiality for the financial statements as a whole, which equates to £10.2m (2020: £10m). We applied this percentage in our determination of performance materiality based on the level of identified misstatements and control deficiencies during the prior period.

Performance materiality for the parent company was set at 75% (2020: 65%) of materiality which equates to £11.8 million (2020: £9.9 million). We applied this percentage in our determination of performance materiality because we did not identify any factors indicating an elevated level of risk.

We agreed to report to the Audit Committee any corrected or uncorrected identified misstatements exceeding £0.79 million (2020: £0.77 million), in addition to other identified misstatements that warranted reporting on qualitative grounds.

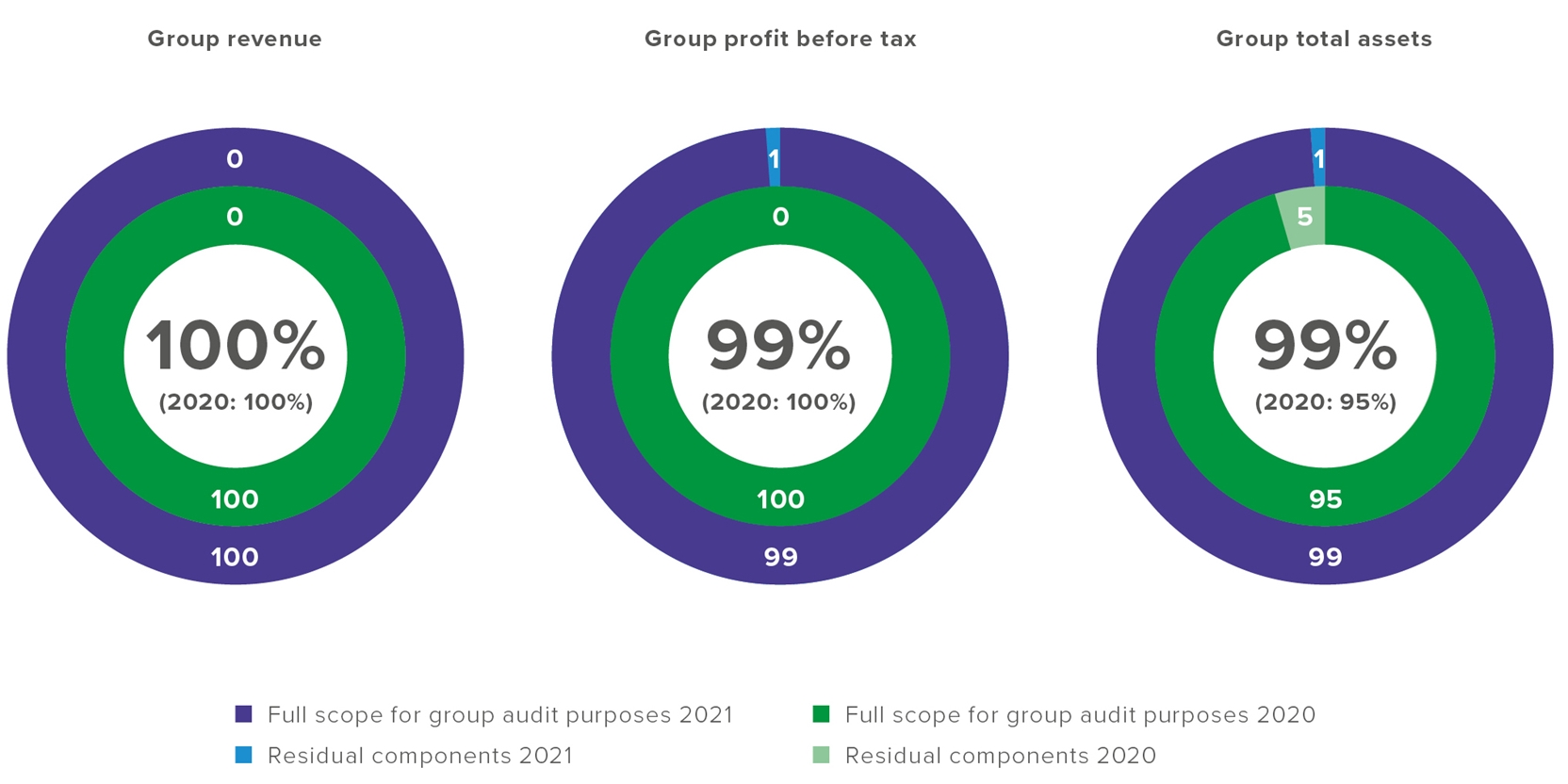

Of the group’s 9 (2020: 11) reporting components, we subjected 3 (2020: 3) to full scope audits for group purposes. For the residual 6 (2020: 8) components, we performed analysis at an aggregated group level to re-examine our assessment that there were no significant risks of material misstatement within these. The components within the scope of our work accounted for the percentages illustrated opposite.

The component materialities ranged from £0.8 million to £15.5 million (2020: £0.7 million to £15 million), having regards to the mix of size and risk profile of the Group across the components.

Our audit of the group and components was all performed by the group audit team.

4. Going concern

The Directors have prepared the financial statements on the going concern basis as they do not intend to liquidate the Group or the Company or to cease their operations, and as they have concluded that the Group’s and the Company’s financial position means that this is realistic. They have also concluded that there are no material uncertainties that could have cast significant doubt over their ability to continue as a going concern for at least a year from the date of approval of the financial statements (“the going concern period”).

We used our knowledge of the Group, its industry, and the general economic environment to identify the inherent risks to its business model and analysed how those risks might affect the Group’s and parent Company’s financial resources or ability to continue operations over the going concern period. The risks that we considered most likely to adversely affect the Group’s and parent Company’s available financial resources over this period was a possible reduction in sales volumes and prices as a consequence of changes in the economic environment such as the end of the stamp duty holiday, including the impact of COVID-19, leading to sustained medium-term decline in revenue and profits.

We also considered less predictable but realistic second order impacts, such as cost inflation due to disruption to the Group’s supply chain.

We considered whether these risks could plausibly affect the liquidity or covenant compliance in the going concern period by assessing the Directors’ sensitivities over the level of available financial resources and covenant thresholds indicated by the Group’s financial forecasts taking account of severe, but plausible adverse effects that could arise from these risks individually and collectively.

Our procedures also included:

- critically assessing assumptions in the base case and downside scenarios, particularly in relation to forecast liquidity, by confirming the completeness and accuracy of forward secured sales and consistency with external information such as industry and economic forecasts;

- assessing whether downside scenarios applied mutually consistent assumptions in aggregate, taking into account all reasonably possible downsides, using our assessment of the possible range of each key assumption and our knowledge of the Group and the industry;

- comparing past budgets to actual results to assess the directors' track record of budgeting accurately;

- inspecting confirmation from banks of the level of cash and cash equivalents held at year end and loan facility documentation including covenant requirements; and

- considering whether the going concern disclosure on page 184 of the financial statements gives a full and accurate description of the directors' assessment of going concern, including the identified risks, dependencies, and related sensitivities.

Our conclusions based on this work:

- we consider that the Directors’ use of the going concern basis of accounting in the preparation of the financial statements is appropriate;

- we have not identified, and concur with the Directors’ assessment that there is not, a material uncertainty related to events or conditions that, individually or collectively, may cast significant doubt on the Group’s or Company's ability to continue as a going concern for the going concern period;

- we have nothing material to add or draw attention to in relation to the Directors’ statement on page 163 of the financial statements on the use of the going concern basis of accounting with no material uncertainties that may cast significant doubt over the Group and Company’s use of that basis for the going concern period, and we found the going concern disclosure on page 184 to be acceptable; and

- the related statement under the Listing Rules set out on page 163 is materially consistent with the financial statements and our audit knowledge.

However, as we cannot predict all future events or conditions and as subsequent events may result in outcomes that are inconsistent with judgements that were reasonable at the time they were made, the above conclusions are not a guarantee that the Group or the Company will continue in operation.

5. Fraud and breaches of laws and regulations – ability to detect

Identifying and responding to risks of material misstatement due to fraud

To identify risks of material misstatement due to fraud (‘fraud risks’) we assessed events or conditions that could indicate an incentive or pressure to commit fraud or provide an opportunity to commit fraud. Our risk assessment procedures included:

- enquiring of Directors, the audit committee, internal legal counsel and inspection of policy documentation as to the Group’s high-level policies and procedures to prevent and detect fraud, including the internal audit function, and the Group’s channel for ‘whistleblowing’, as well as whether they have knowledge of any actual, suspected or alleged fraud;

- reading Board and all relevant committee minutes;

- considering remuneration incentive schemes and performance targets for management and directors, including any revenue and trading margin targets for management remuneration; and

- using analytical procedures to identify any unusual or unexpected relationships.

We communicated identified fraud risks throughout the audit team and remained alert to any indicators of fraud throughout the audit.

As required by auditing standards, and taking into account our overall knowledge of the control environment, we perform procedures to address the risk of management override of controls, in particular the risk that management may be in a position to make inappropriate accounting entries and the risk of bias in accounting estimates and judgements such as cost of sales recognition and the carrying amount of work in progress and land held for development.

On this audit we do not believe there is a fraud risk related to revenue recognition as the accounting for the majority of the Group’s revenue is non-complex and only recognised on the legal completion of the sale, being the point at which the balance of the sales is paid for and title of the property transfers to the customer. There are therefore limited levels of judgement with limited opportunities for manual intervention in the sales process to fraudulently manipulate revenue.

We also identified a fraud risk related to the cost of sales recognition and carrying amount of both land held for development and work in progress in response the significance of the accounting estimate and possible pressures to meet profit targets.

Further detail in respect of Cost of sales recognition and carrying amount of both land held for development and work in progress is set out in the key audit matter disclosures in section 2 of this report.

We also performed procedures including:

- Identifying journal entries and other adjustments to test based on risk criteria and comparing the identified entries to supporting documentation. These included those posted to unusual or unexpected account combinations, including revenue and cash and transfers of work in progress between developments

- Assessing significant accounting estimates for bias

Identifying and responding to risks of material misstatement due to non-compliance with laws and regulations

We identified areas of laws and regulations that could reasonably be expected to have a material effect on the financial statements from our general commercial and sector experience, through discussions with the Directors and other management (as required by auditing standards), and from inspection of the Group’s regulatory and legal correspondence as well as discussion with the Director’s and other management around the policies and procedures regarding compliance with laws and regulations.

As the Group is regulated, our assessment of risks involved gaining an understanding of the control environment including the entity’s procedures for complying with regulatory requirements.

We communicated identified laws and regulations throughout our team and remained alert to any indicators of non-compliance throughout the audit. The potential effect of these laws and regulations on the financial statements varies considerably.

Firstly, the Group is subject to laws and regulations that directly affect the financial statements including financial reporting legislation (including related companies legislation), distributable profits legislation, and taxation legislation and we assessed the extent of compliance with these laws and regulations as part of our procedures on the related financial statement items.

Secondly, the Group is subject to many other laws and regulations where the consequences of non-compliance could have a material effect on amounts or disclosures in the financial statements, for instance through the imposition of fines or litigation or the loss of the Group’s license to operate. We identified the following areas as those most likely to have such an effect: UK planning and building and fire safety regulations, health and safety, anti bribery, anti-money laundering and sanctions checking, employment laws, data protection laws and environmental laws. Auditing standards limit the required audit procedures to identify non-compliance with these laws and regulations to enquiry of the directors and other management and inspection of regulatory and legal correspondence, if any. Therefore, if a breach of operational regulations is not disclosed to us or evident from relevant correspondence, an audit will not detect that breach.

Context of the ability of the audit to detect fraud or breaches of law or regulation

Owing to the inherent limitations of an audit, there is an unavoidable risk that we may not have detected some material misstatements in the financial statements, even though we have properly planned and performed our audit in accordance with auditing standards. For example, the further removed non-compliance with laws and regulations is from the events and transactions reflected in the financial statements, the less likely the inherently limited procedures required by auditing standards would identify it.

In addition, as with any audit, there remained a higher risk of non-detection of fraud, as these may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal controls. Our audit procedures are designed to detect material misstatement. We are not responsible for preventing non-compliance or fraud and cannot be expected to detect non-compliance with all laws and regulations.

6. We have nothing to report on the other information in the Annual Report

The directors are responsible for the other information presented in the Annual Report together with the financial statements. Our opinion on the financial statements does not cover the other information and, accordingly, we do not express an audit opinion or, except as explicitly stated below, any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in doing so, consider whether, based on our financial statements audit work, the information therein is materially misstated or inconsistent with the financial statements or our audit knowledge. Based solely on that work we have not identified material misstatements in the other information.

Strategic report and directors’ report

Based solely on our work on the other information:

- we have not identified material misstatements in the strategic report and the directors’ report;

- in our opinion the information given in those reports for the financial year is consistent with the financial statements; and

- in our opinion those reports have been prepared in accordance with the Companies Act 2006.

Directors’ remuneration report

In our opinion the part of the Directors’ Remuneration Report to be audited has been properly prepared in accordance with the Companies Act 2006.

Disclosures of emerging and principal risks and longer-term viability

We are required to perform procedures to identify whether there is a material inconsistency between the directors’ disclosures in respect of emerging and principal risks and the viability statement, and the financial statements and our audit knowledge.

Based on those procedures, we have nothing material to add or draw attention to in relation to:

- the directors’ confirmation within the viability statement page 78 that they have carried out a robust assessment of the emerging and principal risks facing the Group, including those that would threaten its business model, future performance, solvency and liquidity;

- the risk management report describing disclosures describing these risks and how emerging risks are identified, and explaining how they are being managed and mitigated; and

- the directors’ explanation in the viability statement of how they have assessed the prospects of the Group, over what period they have done so and why they considered that period to be appropriate, and their statement as to whether they have a reasonable expectation that the Group will be able to continue in operation and meet its liabilities as they fall due over the period of their assessment, including any related disclosures drawing attention to any necessary qualifications or assumptions.

We are also required to review the viability statement, set out on page 78 under the Listing Rules. Based on the above procedures, we have concluded that the above disclosures are materially consistent with the financial statements and our audit knowledge.

Our work is limited to assessing these matters in the context of only the knowledge acquired during our financial statements audit. As we cannot predict all future events or conditions and as subsequent events may result in outcomes that are inconsistent with judgements that were reasonable at the time they were made, the absence of anything to report on these statements is not a guarantee as to the Group’s and Company’s longer-term viability.

Corporate governance disclosures

We are required to perform procedures to identify whether there is a material inconsistency between the directors’ corporate governance disclosures and the financial statements and our audit knowledge.

Based on those procedures, we have concluded that each of the following is materially consistent with the financial statements and our audit knowledge:

- the directors’ statement that they consider that the annual report and financial statements taken as a whole is fair, balanced and understandable, and provides the information necessary for shareholders to assess the Group’s position and performance, business model and strategy;

- the section of the annual report describing the work of the Audit Committee, including the significant issues that the audit committee considered in relation to the financial statements, and how these issues were addressed; and

- the section of the annual report that describes the review of the effectiveness of the Group’s risk management and internal control

We are required to review the part of the Governance Report relating to the Group’s compliance with the provisions of the UK Corporate Governance Code specified by the Listing Rules for our review, and to report to you if a governance report has not been prepared by the company. We have nothing to report in these respects.

Based solely on our work on the other information described above:

- with respect to the Governance Report disclosures about internal control and risk management systems in relation to financial reporting processes and about share capital structures:

- we have not identified material misstatements therein; and

- the information therein is consistent with the financial statements; and

- in our opinion, the Governance Report has been prepared in accordance with relevant rules of the Disclosure Guidance and Transparency Rules of the Financial Conduct Authority.

7. We have nothing to report on the other matters on which we are required to report by exception

Under the Companies Act 2006, we are required to report to you if, in our opinion:

- adequate accounting records have not been kept by the parent Company, or returns adequate for our audit have not been received from branches not visited by us; or

- the parent Company financial statements and the part of the Directors’ Remuneration Report to be audited are not in agreement with the accounting records and returns; or

- certain disclosures of directors’ remuneration specified by law are not made; or

- we have not received all the information and explanations we require for our audit.

We have nothing to report in these respects.

5. Respective responsibilities

Directors’ responsibilities

As explained more fully in their statement set out on pages 168 to 169, the directors are responsible for: the preparation of the financial statements including being satisfied that they give a true and fair view; such internal control as they determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error; assessing the Group and parent Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern; and using the going concern basis of accounting unless they either intend to liquidate the Group or the parent Company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue our opinion in an auditor’s report. Reasonable assurance is a high level of assurance, but does not guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements.

A fuller description of our responsibilities is provided on the FRC’s website at www.frc.org.uk/auditorsresponsibilities.

9. The purpose of our audit work and to whom we owe our responsibilities

This report is made solely to the Company’s members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the Company’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company’s members, as a body, for our audit work, for this report, or for the opinions we have formed.

NICK PLUMB (Senior Statutory Auditor)

for and on behalf of KPMG LLP, Statutory Auditor

Chartered Accountants

8 Princes Parade

Liverpool

L3 1QH

15 September 2021

The Auditors have reported on the content of the PDF Annual Report link.

This is a reproduction of their opinion.