"I am pleased to present the Directors’ Remuneration Report for the year ended 30 June 2019."

This is my first report to you as Chair of the Redrow Remuneration Committee. I joined the Redrow Board and Remuneration Committee on 1 August 2017 and formally took over the Chair of the Committee following the AGM on 7 November 2018 and a smooth handover process, for which I would like to thank my predecessor, Debbie Hewitt.

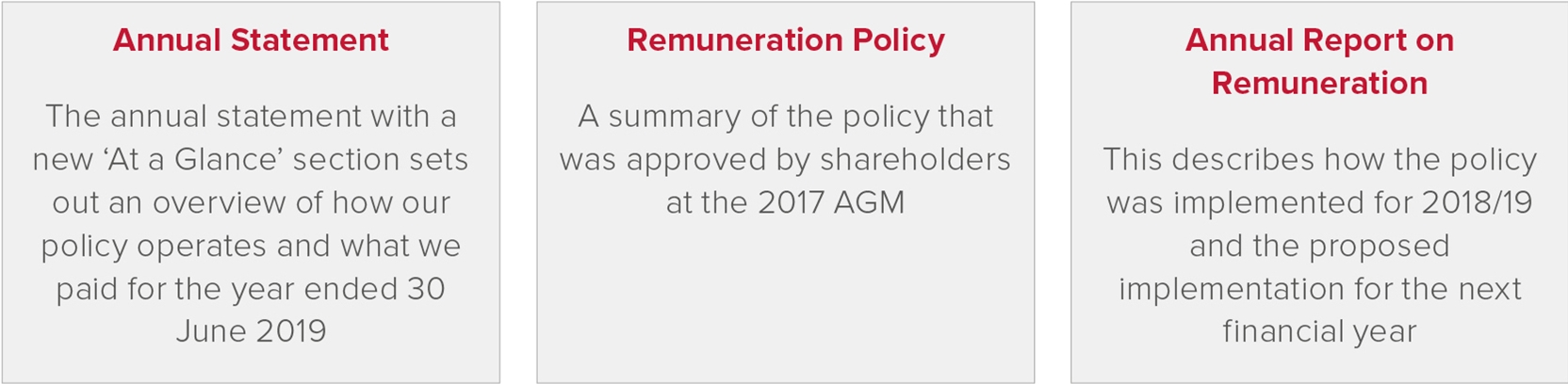

This remuneration report is split into three sections:

Rewarding Performance

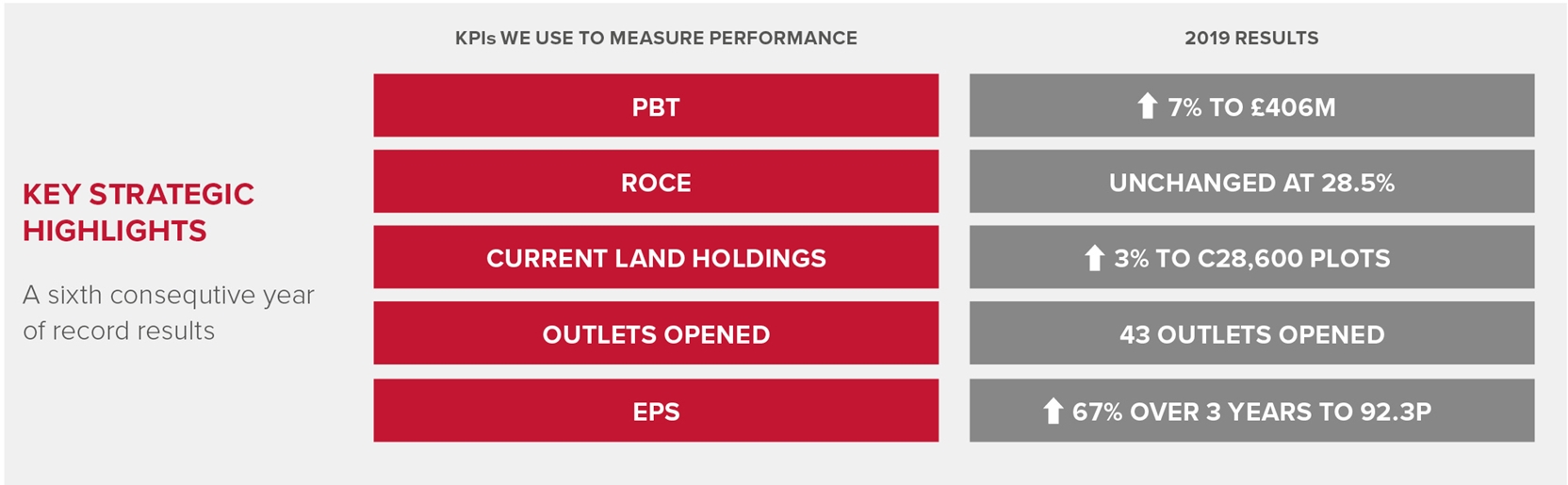

As set out in detail in the Operating and Financial Reviews, the year ended 30 June 2019 was another successful year for Redrow.

Annual bonus

This strong performance resulted in maximum payment for three of the 2018/19 bonus measures (ROCE, outlets opened and land holdings) whilst the PBT delivered of £406m, was on-target for the year. This resulted in a bonus outcome of 85.0% of salary, half of which will be deferred in shares.

LTIP

LTIP awards were granted in 2016 and were subject to stretching EPS and ROCE conditions measured over the three years ending 30 June 2019. EPS for the year was 92.3p and ROCE was 28.5% resulting in both measures exceeding their stretch targets and therefore the LTIP award will vest in full in September 2019.

Despite the uncertainty of Brexit, the housebuilding sector has performed strongly in recent years with high customer demand underpinned by low interest rates and Government initiatives for first time buyers. This has led to higher than typical incentive outcomes at Redrow and amongst our peers. The Remuneration Committee considers carefully the alignment of pay and performance and each year we take into account the prevailing internal and external conditions when setting one and three-year incentive targets.

Overall, the Committee is satisfied that the 2018/19 annual bonus and 2016 LTIP targets were sufficiently stretching and that the resulting outcomes are appropriate in the light of company performance. Therefore, the Committee decided not to apply any discretion to the incentive outcomes.

Aligning Our Short-Term Priorities

Each year we review the choice of annual bonus measures to ensure they remain relevant and reflect the business strategy which is based on delivering strong financial results through ‘Protecting the Future’ and ‘Building Responsibly’. The Committee has made some changes to the measures that will apply for 2019/20.

| 2020 | 2019 | ||

| Financial | |||

| Profit Before Tax | 50% | 30% | ROCE remains an important KPI and will continue to feature in the LTIP but for the Annual bonus PBT is to be used as it is the primary measure of short term financial performance. |

| ROCE | - | 30% | |

| Protecting the Future | |||

| Land | 10% | 20% | The GDV of land acquired remains important and prioritising a strong order book will provide focus on sales volume. |

| Order Book | 10% | - | |

| Outlets Opening | - | 20% | |

| Building Responsibly | |||

| Customer Service | 15% | - |

As set out on pages 26 to 27, we strive to constantly improve our quality and customer service, an important lead indicator of performance. |

| Health & Safety (H&S) | 5% | - | Consistent with our commitment to continuous improvement in H&S, this has been introduced as a bonus target. |

| Personal | |||

| Individual objectives | 10% | - | These will comprise strategy-related objectives which are tailored to each Executive Director. |

We believe the inclusion of Customer Service and Health & Safety, as well as personal objectives, provides a more rounded assessment of management’s performance while continuing to have a high weighting towards financial results. In particular, the Committee is keen to ensure that lead indicators are included to ensure a more balanced approach to performance assessment. The revised measures are felt to be more appropriately aligned with our overall business strategy and vision.

Board Changes

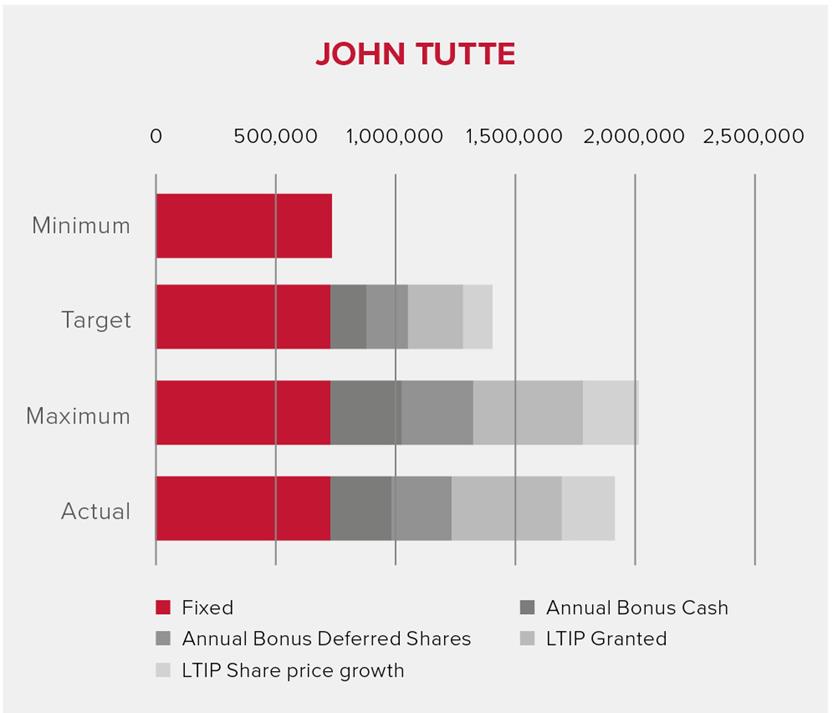

Nearly 45 years after founding Redrow, Steve Morgan stepped down as Chairman and John Tutte became Executive Chairman from 1 April 2019. John Tutte’s salary and remuneration terms were unchanged following the change in role. His salary was reviewed as usual for 2019/20 with the result that it will be increased by 2.0%, which is less than the general workforce increases effective from 1 July 2019.

The Board was pleased to promote internally with Matthew Pratt joining the Board as Chief Operating Officer on the same date. Matthew’s salary has been set at £410,000p.a. which reflected his experience and his responsibilities for the operational management of the Group and the implementation of strategic plans. His salary will next be eligible for a review at the usual 2020 review date. Matthew’s pension contribution has been set at a lower rate of 10% of salary. The Committee will consider directors’ pension contributions as part of the policy review for approval in 2020.

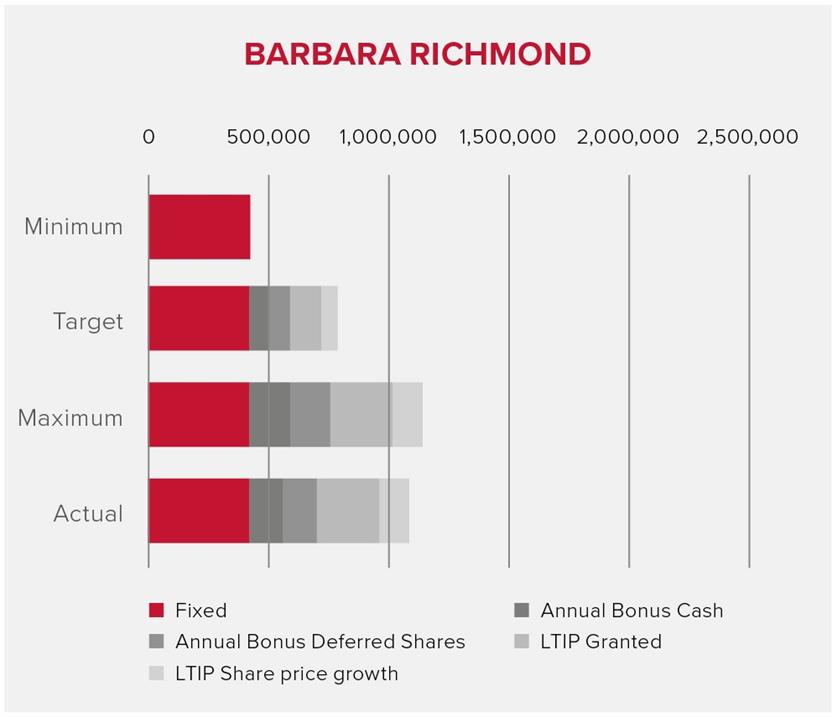

With the successful implementation of the Group’s succession plans, Barbara Richmond’s role on the Board has taken on greater importance and the Committee concluded that a salary adjustment was required to reflect the changing strategic needs and objectives of the Group, the broad responsibilities she undertakes which have expanded to include sales initiatives, IT, procurement and M&A; and the need to retain and reward Barbara at a time when there have been several Finance Director board changes in our sector. The Remuneration Committee is aware of the scrutiny surrounding above workforce increases to directors’ salaries but concluded that it was appropriate to increase Barbara’s salary by 9.5% to £370,000 p.a. effective from 1 July 2019.

UK Corporate Governance Code

The Committee has considered the various changes to the regulatory environment as they relate to executive remuneration and welcomes the new UK Corporate Governance Code (the “new Code”). The Committee has adopted a number of changes early and preparatory steps have already been taken in respect of the following:

- The Committee’s Terms of Reference have been updated to reflect the expanded scope required by the new Code including responsibility for setting remuneration for the Chairman, Executive Directors, below Board members of the executive team and the Company Secretary. The terms were updated to require the Committee to take account of Group-wide remuneration and policies when setting executive pay – workforce pay was reviewed in advance of setting directors’ pay for the current year.

- The operation of the annual bonus plan and the LTIPs have been reviewed to ensure that the Committee has necessary discretion to override formulaic outcomes (as required by the new Code).

- The malus and clawback provisions in the annual bonus plan and LTIP have also been reviewed to ensure they reflect emerging good practice; and

- The appointment of myself as the designated Non Executive Director to facilitate workforce engagement.

Looking Forward

This year we will be reviewing our remuneration policy to take account of the significant changes to the remuneration landscape and the evolution of good practice features which have been encouraged by the new Code, institutional shareholders and shareholder bodies. As part of this review, we will be consulting with a range of stakeholders which will include our largest shareholders. A new policy will be put to a shareholder vote at the November 2020 AGM.

At the 2018 AGM, the Directors' Remuneration Report received 99.35% votes in favour. I look forward to your support at the upcoming AGM.

Vanda Murray OBE

Chair of the Remuneration Committee

This report has been prepared in accordance with the UK Corporate Governance Code, the relevant provisions of the Listing Rules and Schedule 8 of the Large and Medium-sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013.

At A Glance

Remuneration Principles

Our governing principles on executive remuneration are based on the five principles below.

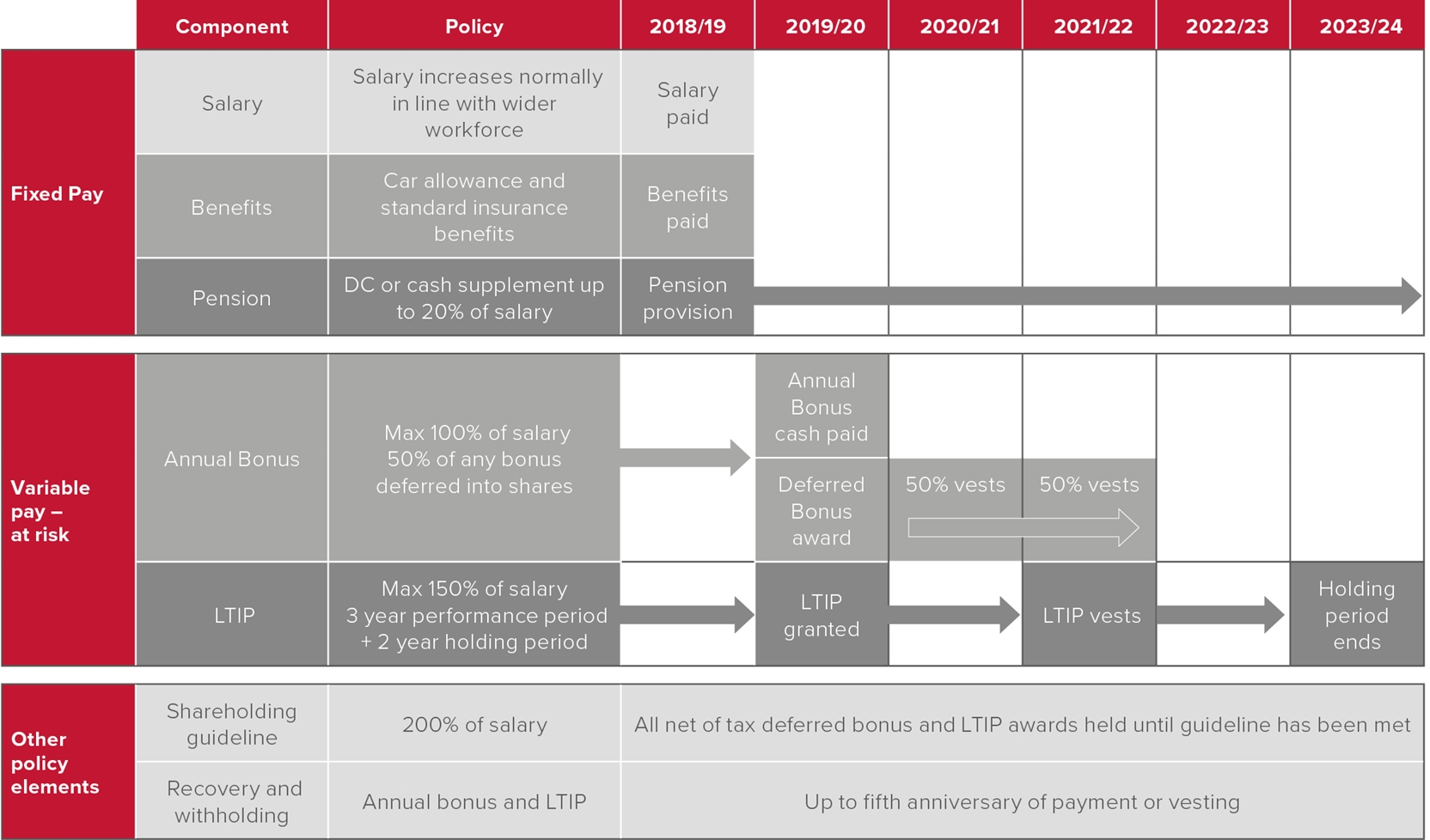

Our Remuneration Policy

Summary of our policy and how remuneration is delivered over time.

Performance Outcomes

Remuneration Outcomes

The Remuneration Policy

The Remuneration Policy became effective following shareholder approval at the 2017 Annual General Meeting. An extract of the Remuneration Policy table (with updated references, where relevant) and supporting disclosures is reproduced below for information only. The full Remuneration Policy is contained on pages 79 to 86 of the 2017 Annual Report, which is available in the Investor Relations section of the Group’s website, investors.redrowplc.co.uk/reports-and-presentations.

Policy Table for Executive Directors

Operation

Salaries are determined by the Committee taking into account all relevant factors such as:

- the size and complexity of the Company, the scope and responsibilities of the role, the skills and experience of the individual and performance in role.

- the Committee’s assessment of the competitive market positioning of base salaries is based on consideration of market data from UK companies of similar size and complexity and companies in the house-building sector.

- salaries are normally reviewed annually, with any changes effective at the start of the financial year.

Maximum

There is no prescribed maximum salary. Any salary increases will normally be in line with those of the wider workforce.

The Committee has discretion to award larger increases where it considers this appropriate, such as to reflect (for example):

- a significant change in the size and complexity of the Company;

- an increase in scope and responsibility of the role, or a change in role;

- an Executive Director being moved to market positioning over time; and

- an Executive Director falling below competitive market positioning.

Performance framework

N/A

Operation

Benefits may include: a company car (or equivalent cash allowance), private medical insurance, permanent health insurance, fixed term group income protection and a death in service benefit, and where appropriate any tax payable thereon.

Executive Directors may also participate in all-employee share plans on the same basis as other employees.

The Committee has discretion to include, where it considers it appropriate to do so, other benefits to reflect specific individual circumstances, such as housing, relocation, travel, or other expatriate allowances.

Maximum

Benefit provision, for which there is no prescribed monetary maximum, is set at an appropriate level for the specific nature and location of the role.

Participation in all-employee share plans is subject to statutory limits.

Performance framework

N/A

Operation

Individuals are eligible to participate in the Company’s Defined Contribution (DC) pension scheme or receive a pension allowance cash supplement.

Executive Directors who are members of the Company’s Defined Benefit (DB) pension scheme will continue to receive benefits under the terms of that scheme. There will be no new entrants or accrual of future benefits under the DB scheme.

Maximum

The maximum DC contribution/cash supplement (in respect of a financial year) is 20% of base salary.

Performance framework

N/A

Operation

The Committee determines participation levels each year. Targets are set by the Committee at the start of the relevant financial year and are assessed following the year end.

A portion (currently 50%) of any bonus earned will be deferred into Redrow shares, which are awarded in the form of nil-cost options which vest after a period set by the Committee. Currently, half of the deferred shares vests after one year and half after two years, subject to continued employment.

Following exercise of a vested deferred share award, participants will be entitled to receive an amount equal to the aggregate of any dividends which they would have been entitled to receive as a shareholder during the period between the grant and satisfaction of the award.

In future years, the Committee retains the discretion to change the deferred amount and/or lengthen the deferral period.

Where appropriate, the Committee may determine that deferral is in the form of an equivalent cash award (which in all other respects mirrors the terms of the deferred share awards).

Clawback provisions apply to both the cash and deferred elements.

Maximum

100% of salary

Performance framework

Performance is assessed against key financial and operational performance measures linked to the delivery of the strategy and shareholder value determined each year by the Committee.

The 2019/20 performance measures are:

- 50% based on profit before tax;

- 10% based on Closing private order book;

- 10% based on land acquired;

- 15% on Customer Service;

- 5% based on health and safety; and

- 10% based on personal objectives.

The Committee retains discretion to adjust the measures and/or weightings in future years to reflect prevailing financial, strategic and operational objectives of the business or of the individual. However, a minimum of 50% of the total will always be based on key financial measures.

No bonus will be payable for performance below threshold levels set by the Committee.

The Committee has discretion to adjust the level of payout if the outcome from a formulaic assessment does not appropriately reflect underlying business performance.

Operation

Awards may be made under the Redrow plc 2014 Long Term Incentive Plan (LTIP).

Awards are normally in the form of nil-cost options. The Committee may also determine that awards are made in the form of conditional share awards or as an equivalent cash award (which in all other respects mirrors the terms of the LTIP).

Awards normally vest subject to the satisfaction of performance conditions measured over a period of at least three years. Vested award will normally be subject to an additional holding period of two years.

Clawback provisions apply.

Awards may incorporate the right to receive (in cash or shares) the aggregate value of dividends paid on vested shares between the vesting date and the date on which the awards are released following the holding period, on such basis as the Committee may determine, which may assume the reinvestment of these dividends in shares on a cumulative basis.

Maximum

The maximum award which may be granted in respect of a financial year will normally not exceed 150% of salary.

However, in exceptional circumstances only, the Committee may make awards of up to 200% of salary.

Performance framework

The LTIP is based on performance measures aligned to the creation of long-term shareholder value, measured over a performance period of at least three years. The current performance measures are:

- 50% based on earnings per share (EPS); and

- 50% based on return on capital employed (ROCE)

For threshold performance, 20% of salary would normally vest.

The Committee retains discretion to include additional or alternative financial performance measures and/or adjust the weightings in future years to reflect prevailing strategic or operational objectives of the business aligned with shareholder value creation.

Performance conditions applicable to LTIP awards may be amended if an event occurs which cause the Committee to consider that an amended performance condition would be more appropriate and not materially less difficult to satisfy.

Charitable donations

Where an individual waives any current or future right or entitlement to a remuneration payment or other benefit, which they would otherwise be eligible to receive under any of the components set out in the Policy Table on pages 65 to 67, the Committee may determine that a charitable donation, which is, in its opinion, equivalent to the value of that payment or benefit, may be made by the Company.

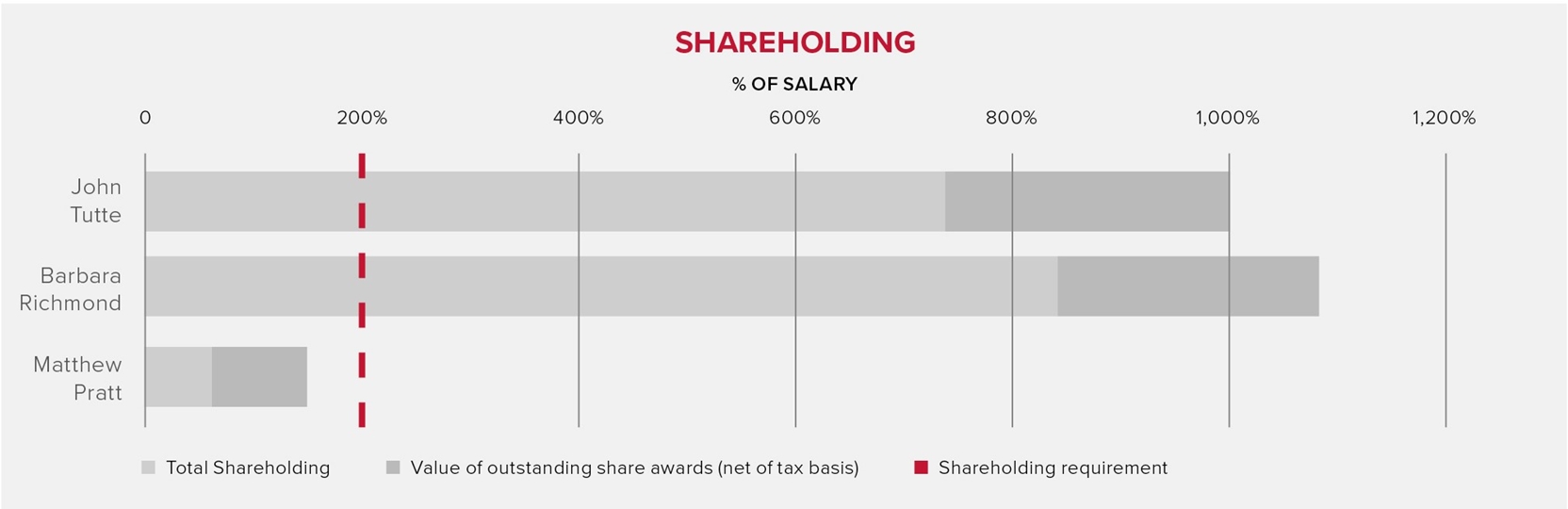

Executive shareholding guidelines

Executive Directors are expected to build and retain a shareholding in the Group at least equivalent to 200% of base salary. Until the shareholding guideline has been met Executives will be required to retain all deferred bonus shares and LTIP shares on a net of tax basis.

Clawback

For awards under the annual bonus plan (including deferred share awards) and awards made since the introduction of the 2014 LTIP, the Committee has discretion to clawback awards in the event of a material misstatement of the Company’s audited financial results or employee misconduct. For awards to be made in 2019/20, additional triggers relating to an error in the calculation of a performance condition, reputational damage suffered and any other events the Committee considers specifically relevant to Redrow will also apply.

In such circumstances, at any time prior to the fifth anniversary of the payment of any cash bonus or vesting of a deferred bonus/ LTIP award, the Committee has discretion to:

- reduce, cancel or impose further conditions on outstanding deferred bonus/LTIP awards; or

- require the participant to repay (in cash or shares) some or all of the value delivered from a deferred bonus/LTIP awards; and/or

- require the participant to repay some or all of any cash bonus received.

Where a charitable donation has been made in accordance with the Remuneration Policy, clawback will not apply.

For deferred bonus plan awards, if a participant’s gross misconduct has resulted in the material misstatement of the Group financial statements (or the financial statements of one of its subsidiaries), any unexercised awards will lapse immediately and the participant will forfeit any shares previously acquired under awards made under that plan.

Service contracts

The service agreements of the Executive Directors are rolling contracts which were entered into on the dates shown in the table below:

| Name | Contract Date | Notice period from the Director | Notice period from the Company |

| John Tutte | 01/04/19 | 12 months | 12 months |

| Barbara Richmond | 18/01/10 | 6 months | 12 months |

| Matthew Pratt | 01/04/19 | 6 months | 6 months |

The service agreements provide for formal notice to be served to terminate the agreement, by either the Company or the Executive Director, with the required period of notice shown in the table. The agreements and letters of appointment do not include any provisions for pre-determined compensation for early termination. The Committee may terminate service agreements immediately by making a payment in lieu of notice consisting of base salary, benefits and pension for the unexpired period of notice. At the discretion of the Committee, this payment may be made as instalments over the period, subject to a duty to mitigate, or as a lump sum.

For future appointments, it is the Committee’s policy that notice periods will normally be 6 months from both the Director and the Company initially and thereafter, 12 months from both the Director and the Company, and that payments in lieu of notice will comprise no more than base salary, benefits and pension only over the unexpired period of notice. This policy applies to Matthew Pratt who was appointed to the Board on 1 April 2019, after the approval of this Remuneration Policy and was appointed on 6 months’ notice.

The Non-Executive Directors’ terms of appointment are detailed in formal letters of appointment as shown in the table below. Each appointment is for a fixed initial period of three years although this term is terminable upon either party giving three months’ notice.

| Name | Position | Date of initial appointment | Current date of appointment |

| Nick Hewson | Non-Executive | 01/12/12 | 01/12/18 |

| Sir Michael Lyons | Non-Executive | 06/01/15 | 06/01/18 |

| Vanda Murray | Non-Executive | 01/08/17 | 01/08/17 |

Annual Remuneration Report

Statement of Implementation for 2020

This section summarises how the Committee intends to operate the Remuneration Policy for the year ending 30 June 2020.

Salary

The Committee’s policy on salary increases, as set out in the Remuneration Policy, is that they should normally be in line with increases for employees within the business. This approach has been applied consistently by the Committee over a number of years.

The Remuneration Committee has decided to increase Barbara Richmond’s salary by 9.5% to £370,000 to reflect her continuing strong contribution since joining the Company in January 2010 and the importance of her role following changes to the composition of our Board. The Remuneration Committee is aware of the scrutiny surrounding significant increases to directors’ salaries and has demonstrated a prudent approach to executive pay changes but believes that an adjustment is required in this case. In taking this decision, the Remuneration Committee considered the following:

- Barbara’s role will take greater importance following Steve Morgan’s departure and John Tutte’s move to Executive Chairman;

- The broad responsibilities Barbara undertakes which have expanded to include sales initiatives, IT, procurement and M&A;

- The importance of retaining Barbara particularly given the recent high turnover of finance directors in the housebuilding sector; and

- Salary levels for finance directors in the sector and in FTSE 250 companies of a broadly similar size. This was not a driver behind the proposal but was considered to provide the Committee with assurance that the proposed salary was not ahead of the market rate for the role.

In April 2019, Matthew Pratt joined the Board as Chief Operating Officer and John Tutte became Executive Chairman. On appointment, Matthew’s salary had been set at £410,000 p.a., which reflected his experience and his responsibilities for the operational management of the Group and the implementation of strategic plans. His salary shall remain unchanged for 2020. On the move to Executive Chairman, John Tutte’s salary was unchanged. His salary was reviewed as usual and will increase by 2.0% which is less than the general workforce increases effective from 1 July 2019.

The salaries for 2020 are effective from 1 July 2019 and are as follows:

| £'000 |

1 July 2019 |

1 July 2018 |

Change |

| John Tutte | 610 | 598 | 2.0% |

| Barbara Richmond | 370 | 338 | 9.5% |

| Matthew Pratt | 410 | 410 | 0% |

Pension

John Tutte and Barbara Richmond will continue to receive a contribution towards pension of 20% of salary. Matthew Pratt’s pension contribution was agreed at a lower rate of 10% of salary which was a reduction from his previous package which carried a contribution of 15%. His 10% contribution level was set prior to The Investment Association’s update in January 2019 which recommended that pension contributions for new joiners should be in line with the majority of the workforce. The Remuneration Committee will consider directors’ pension contribution levels as part of the forthcoming 2020 Remuneration Policy review.

Annual Bonus

Following a review of bonus measures in light of the Group’s short to medium term objectives, the Committee has decided to make changes to the measures that will apply for 2019/20.

The measures support the three key strategic objectives – delivering financial results, protecting the future and building responsibly.

| 2020 | 2019 | ||

| Financial | |||

| Profit Before Tax | 50% | 30% | ROCE remains an important KPI and will continue to feature in the LTIP but for the Annual bonus PBT is to be used as it is the primary measure of short term financial performance. |

| ROCE | - | 30% | |

| Protecting the Future | |||

| Land | 10% | 20% |

The GDV of Land acquired remains important and prioritising a strong order book will provide focus on sales volume. |

| Order Book | 10% | - | |

| Outlets Opening | - | 20% | |

| Building Responsibly | |||

| Customer Service | 15% | - | As set out on pages 26 to 27, we strive to constantly improve our quality and customer service, an important lead indicator of performance. Consistent with our commitment to continuous improvement in H&S, this has been introduced as a bonus target. |

| Health & Safety (H&S) | 5% | - | |

| Personal | |||

| Individual objectives | 10% | - | These will comprise strategy-related objectives which are tailored to teach Executive Director. |

The above measures support our aim for customer service excellence while maintaining focus on quality land investment which will drive long term profitability. We believe the inclusion of Health & Safety, as well as personal objectives provides a more rounded assessment of management’s performance while continuing to have a high weighting towards financial results. The revised measures are felt to be more appropriately aligned with our overall business strategy and vision.

It is the current intention that the targets will be disclosed in the FY 2020 Remuneration Report provided the Committee is comfortable they are no longer commercially sensitive at the time.

LTIP awards to be granted during 2020

LTIP awards in the FY 2020 financial year will be made at the level of 150% of salary. Consistent with previous years, the 2020 LTIP awards will be subject to EPS and ROCE metrics, each with a 50% weighting.

The Committee believes that these two measures are transparent, are easy to understand, track and communicate, are cost effective to measure and fundamentally aligned to the strategic ambitions that have been communicated to the market:

- EPS ensures that the team delivers strong ‘bottom line’ profitability and growth for shareholders; and

- ROCE provides balance by requiring that profit is delivered efficiently from a capital perspective.

Both measures have a three-year performance period ending on 30 June 2022 and the targets are set out in the table below:

| Award vesting level as % of salary (for each component) | EPS for 2022 | ROCE for 2022 |

| Nil | Below 105.0p | Below 23.4% |

| 10% | 105.0p | 23.4% |

| 30% | 110.0p | 24.4% |

| 75% | 115.0p or above | 25.4% or above |

| Vesting between the points above is on a sliding scale basis | ||

The Remuneration Committee has considered carefully the targets to apply for each measure by taking into account internal and external forecasts. Taking these factors into account, the Committee decided it is appropriate to set an EPS target that is lower than for the awards made last year given the announced changes to the Help to Buy scheme from 2021 and continuing macroeconomic uncertainty. The Committee is satisfied the EPS targets are suitably stretching given the stretch target of 115p would require a 25% growth on 2019 EPS, which itself was a record year.

As a ratio measuring how efficiently the Company is at using its capital to generate profit, it is unrealistic to assume that ROCE can be maintained at its exceptional current level without affecting the Group’s ability to grow in the longer-term. Whilst the ROCE targets are lower than those set for last year’s award, the Committee believe they are demanding after taking into account the outlook for the market, cost pressures and the need to invest for the future.

The Remuneration Committee has discretion to adjust the number of shares vesting from the award if it considers that performance in the metrics above is not sufficiently reflective of the general growth created by the market.

In line with our Policy, these awards will be subject to an additional two year post-vesting holding period.

Non-Executive Director Fees

The base fee for a Non-Executive Director remains unchanged at £55k p.a. The Company pays an additional fee of £10k p.a. to Committee Chairs and an additional fee of £10k p.a. to the Senior Independent Director.

Outcomes in Respect of 2019

The tables below set out the remuneration for the Directors in respect of 2019. Further discussion of each of the components is set out on the pages which follow. Where indicated, these disclosures have been audited.

Single Total Figure of Remuneration Table (Audited)

The remuneration of the Executive Directors in respect of 2019 is shown in the table below (with the prior year comparative):

| Salary | Benefits (iii) | Annual bonus (iv) | LTIP (v) | Pensions (vi) | Total | |||||||

| £'000 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 |

| John Tutte (i) | 598 | 583 | 16 | 16 | 508 | 564 | 681 | 670 | 120 | 117 | 1,923 | 1,950 |

| Barbara Richmond | 338 | 330 | 19 | 17 | 287 | 319 | 385 | 378 | 68 | 66 | 1,097 | 1,110 |

| Matthew Pratt (ii) | 103 | - | 5 | - | 87 | - | 175 | - | 10 | - | 380 | - |

(i) John Tutte served as Chief Executive Officer during FY 2018 and until 1 April 2019 when he became Executive Chairman. His remuneration terms remained unchanged on his change of role.

(ii) Matthew Pratt was appointed to the Board as Chief Operating Officer on 1 April 2019. His remuneration relates to his period on the Board except for the 2019 LTIP value which is in relation to the award he was granted in September 2016 when he was not on the Board.

(iii) Benefits include a fully expensed company car (or equivalent cash allowance) and private health insurance.

(iv) Annual bonus represents the full value of the bonus awarded in respect of the relevant financial year. Details of performance targets are set out below. Half of the bonus is deferred into Redrow shares, which vests in two tranches of 50% each, on the first and second anniversaries of the grant date, subject to continued employment.

(v) LTIP represents the value of the LTIP award which vests in respect of the 3-year performance period ending in the relevant financial year. The 2019 column includes the value of the 2016 LTIP award which will vest in full on 12 September 2019, using the average share price over the last three months of FY 2019 including any dividend equivalent paid. The 2018 column includes the vested value of the 2015 LTIP award (which vested at 100% of maximum), based on the share price on the date of vesting (14 September 2018).

(vi) Pension includes the value of the cash allowance paid to John Tutte and Barbara Richmond in respect of the relevant year and for Matthew Pratt, the contribution from 1 April 2019 to 30 June 2019.

The fees of the Non-Executive Directors in respect of 2019 are shown in the table below (with the prior year comparative).

| Fees | ||

| £'000 | 2019 | 2018 |

| Steve Morgan (i) | 7 | 8 |

| Debbie Hewitt (ii) | 26 | 75 |

| Nick Hewson | 72 | 63 |

| Sir Michael Lyons | 65 | 63 |

| Vanda Murray | 61 | 50 |

| Liz Peace (iii) | - | 8 |

| (i) Steve Morgan served as Non-Executive Chairman from 1 July 2018 until his retirement from the Board on 31 March 2019. The disclosure in this table and footnote are in reference to that period. Steve Morgan drew a nominal fee of £10k per annum which he donated via Payroll Giving to The Steve Morgan Foundation, a UK registered charity of which Steve Morgan is a trustee. The Company also made a donation in 2019 to The Steve Morgan Foundation of £218k (2018: £218k) (being the balance for this period of Steve Morgan’s notional annual fee of £300k per annum less the £10k nominal fee). | ||

| (ii) Debbie Hewitt retired as a Non-Executive Director on 7 November 2018. | ||

| (iii) Liz Peace retired as a Non-Executive Director on 31 August 2017. | ||

Annual bonus

The maximum bonus opportunity for the Executive Directors during 2019 continued to be 100% of salary, in line with the Remuneration Policy. This was based on the achievement of stretching targets under a balanced scorecard of four key performance measures. The scorecard combined measures which represent an appropriate balance between ‘backward looking’ financial performance (PBT and ROCE) and ‘forward looking’ strategic and operational measures (land holdings and outlet openings) which support shareholder value creation over the medium to long-term.

| % of bonus opportunity | Rationale | |

| PBT | 30% | A fundamental measure of annual profitability |

| ROCE | 30% | A measure of how effectively we use our capital base |

| Land holdings | 20% | Measures the foundation for our future growth |

| Outlets opened | 20% | A fundamental indicator of future growth |

As described in detail on pages 1 to 37 of this Annual Report, 2019 was another outstanding year for Redrow.

As a result of the targets for maximum payment for three of the measures (ROCE, outlets opened and land holdings) being exceeded and performance on PBT on-target for the year, the Committee determined that the bonus should pay out at 85.0% of maximum, resulting in bonus awards to the Executive Directors as shown in the Single Total Figure of Remuneration on page 71.

The 2019 targets and outcomes are disclosed in the following table:

| 2019 Target Range | ||||||

|

% of bonus opportunity |

Threshold payout (10% of maximum) |

Target payout (50% maximum) |

Maximum payout |

Actual 2019 performance |

Payout (% of total bonus opportunity) |

|

| PBT | 30 | £386m | £406m | £426m | £406m | 15% |

| ROCE | 30 | 23.3% | 24.5% | 25.7% | 27.5%* | 30% |

| GDV of land acquired | 20 | 2.0bn | 2.1bn | 2.2bn | 2.3bn | 20% |

| Outlets opened in year | 20 | 38 | 40 | 42 | 43 | 20% |

| Total | 100% | 85% | ||||

| * Calculated on a rolling monthly basis. | ||||||

The Committee is satisfied that the bonus outcome is reflective of the results delivered by the business during the year.

Executive Directors are required to defer 50% of any bonus earned into shares, half of which will vest after one year and the remaining half after two years, subject to continued employment and clawback. Clawback and malus provisions for both the cash and deferred share elements will apply.

Long Term Incentive Plan (LTIP)

The LTIP is designed to motivate and reward long-term performance and delivery of the strategy and provide alignment with Redrow shareholders.

The sections below summarise details of the LTIP awards which vested in respect of 2019 (2016 awards) and which were granted during the 2019 financial year.

LTIP awards vesting in respect of 2019

The LTIP awards granted in September 2016 were based on performance over the three year performance period ending 30 June 2019. Based on performance against the EPS and ROCE targets set when the award was granted, summarised in the table following, the Committee determined that these awards will vest in full on 12 September 2019.

| Award vesting level as a % of share options granted (for each component) | EPS for 2019* | ROCE for 2019 |

| Nil | Below 74.99p | Below 21.0% |

| 10% | 74.99p | 21.0% |

| 30% | 83.39p | 23% |

| 50% | 91.69p or above | 25% or above |

|

Vesting between the points above is on a sliding scale basis |

||

| Actual performance | 92.3p* | 28.5% |

| Vesting (% of total award) | 50% | 50% |

| * As outlined in the Cash Return Circular published during the year. An upwards adjustment of the EPS performance target was necessary to neutralise the effect of the return of cash and share consolidation. See pages 81 to 82. | ||

The Remuneration Committee is satisfied that this very strong performance over the last three years warrants full vesting.

The estimated value of these vested awards is included in the 2019 LTIP column of the Single Total Figure of Remuneration on page 71.

Scheme Interests Awarded During 2019 (Audited)

The following table sets out details of LTIP awards to Executive Directors during the 2019 financial year.

| Executive Director | Number of awards granted | Basis of award | Face value* |

Threshold vesting (% of maximum) |

Vesting date |

| John Tutte | 152,370 | 150% of salary | £897k | 20% | September 2021 |

| Barbara Richmond | 86,122 | 150% of salary | £507k | 20% | September 2021 |

* The face value has been calculated using the average share price used to determine the number of shares awarded, being 588.7p (the average, over the three days to the date of grant).

Awards to John Tutte and Barbara Richmond are made in the form of nil-cost options.

The LTIP awards granted on 11 September 2018 will vest in September 2021 based on performance over the three year performance period ending 30 June 2021 as follows:

|

Award vesting level as a % of share options granted (for each component) |

EPS for 2021 | ROCE for 2021 |

| Nil | Below 110.25p | Below 25.8% |

| 6.67% | 110.25p | 25.8% |

| 20% | 115.50p | 26.8% |

| 50% | 120.75p or above | 27.8% or above |

| Vesting between the points above is on a sliding scale basis. An upwards adjustment of the EPS performance targets for the unvested LTIPs was necessary to neutralise the effect of the return of cash and share consolidation on these awards. See pages 81 to 82. | ||

Deferred Bonus Plan awards, being 50% of the bonus earned relating to FY2018 performance, were granted during the year as set out below:

| Executive Director |

Number of awards granted |

Face value* |

Portion of bonus deferred |

Vesting date |

| John Tutte | 47,923 | £282k | 50% |

50% in September 2019 and 50% in September 2020 |

| Barbara Richmond | 27,062 | £159k | 50% | 50% in September 2019 and 50% in September 2020 |

* The face value has been calculated using the average share price used to determine the number of shares awarded, being 588.7p (the average, over the three days to the date of grant).

Steve Morgan’s Retirement

During the year, Steve Morgan served as Non-Executive Chairman until his retirement from the Board on 31 March 2019. Steve received a nominal fee of £7k for the 9 month period he was in office and he donated this via Payroll Giving to The Steve Morgan Foundation, a UK registered charity of which Steve Morgan is a trustee. The Company also made a donation in 2019 to The Steve Morgan Foundation of £218k (being the balance for this period of Steve Morgan’s notional annual fee of £300k per annum (£225k for 9 months) less the £7k nominal fee). Steve did not receive any payment for loss of office.

In September 2016, while Steve occupied the role of Executive Chairman, he was granted a cash LTIP award over 118,867 shares. Under the shareholder approved LTIP rules, his transition from Executive to Non-Executive Chairman was not a ‘leaver’ event as he continued to be an office holder. On retiring from the Board on 31 March 2019, Steve was considered by the Remuneration Committee to be a good leaver. As such, his award will vest on the normal vesting date (12 September 2019) and will be subject to pro rating based on his service to 31 March 2019 relative to the three year performance period to 30 June 2019. EPS and ROCE performance resulted in 100% of the award capable of vesting. The pro rata reduction will result in 108,961 awards vesting on 12 September 2019 and this will be receivable in cash.

Shareholding guidelines and share interests

Under our shareholding guidelines, Executive Directors are expected to build and retain a shareholding in the Group at least equivalent to 200% of base salary. Until the shareholding guideline has been met Executives will be required to retain all deferred bonus shares and LTIP shares on a net of tax basis. As shown in the table below, John Tutte and Barbara Richmond meet this guideline. *Matthew Pratt exceeded his assigned shareholding guideline prior to his promotion to Chief Operating Officer. As noted above, Matthew is expected to retain all Deferred Bonus Plan and LTIP shares on a net of tax basis until the shareholding guideline is met. Non-Executive Directors are not subject to shareholding guidelines.

Statement of Shareholding and Scheme Interests (Audited)

The following table sets out the shareholding (including connected persons) of the Directors in the Company as at 30 June 2019 and current interests in long-term incentives.

|

Number of shares beneficially held at 30 June 2019 |

Shareholding as % of salary |

Guideline met? | |

| Executive Directors | |||

| John Tutte | 755,686 | 723% | Yes |

| Barbara Richmond | 534,122 | 842% | Yes |

| Matthew Pratt | 43,515 | 62% | No* |

| Non-Executive Directors | |||

| Steve Morgan (resigned from the Board on 31 March 2019) | |||

| Held through Bridgemere Securities Limited | 69,939,090 | ||

| Held by other parties connected with Steve Morgan (i) | 36,714,285 | ||

| Total | 106,653,375 | ||

| Debbie Hewitt (resigned from the Board on 7 November 2018) (ii) | 30,687 | ||

| Nick Hewson | 19,523 | ||

| Sir Michael Lyons | 2,857 | ||

| Vanda Murray | 3,333 |

(i) Steve Morgan holds no beneficial interest in these ordinary shares.

(ii) The shareholding shown for Debbie Hewitt is as at the date of her resignation from the Board.

Shareholding as a percentage of salary is calculated using the shareholding and base salary as at 1 July 2019 and the average share price for the final quarter of the financial year ended 30 June 2019.

The table below provides details of the interests of the Executive Directors in incentive awards during the year.

|

Awards held at 30 June 2018 |

Grant Date |

Share Price on Grant £ |

Award Vested |

Awards granted in year |

Awards Excercised in year |

Awards held at 30 June 2019 |

Excercise Price £ |

From | To | |

| John Tutte | ||||||||||

| SAYE 2017 | 3,673 | 30/10/17 | 6.12 | - | - | - | 3,673 | 4.90 | 01/01/21 | 01/07/21 |

| LTIP 2015 | 112,348 | 14/09/15 | 4.94 | 112,348 | - | (112,348) | - | 14/09/18 | 14/09/25 | |

| LTIP 2016 | 138,882 | 12/09/16 | 4.097 | - | - | - | 138,882 | 12/09/19 | 12/09/26 | |

| LTIP 2017 | 147,346 | 15/11/17 | 5.935 | - | - | - | 147,346 | 15/11/20 | 15/11/27 | |

| LTIP 2018 | - | 10/09/18 | 5.42 | - | 152,370 | - | 152,370 | 10/09/21 | 10/09/28 | |

| DEF BONUS 2016 | 33,866 | 12/09/16 | 4.097 | 33,866 | - | (33,866) | - | 12/09/17 | 12/09/26 | |

| DEF BONUS 2017 | 45,159 | 11/09/17 | 6.30 | 22,580 | - | (22,580) | 22,579 | 11/09/18 | 11/09/27 | |

| DEF BONUS 2018 | - | 10/09/18 | 5.42 | - | 47,923 | - | 47,923 | 10/09/19 | 10/09/28 | |

| 481,274 | 168,794 | 200,293 | (168,794) | 512,773 |

|

Awards held at 30 June 2018 |

Grant Date |

Share Price on Grant £ |

Award Vested |

Awards granted in year |

Awards Excercised in year |

Awards held at 30 June 2019 |

Excercise Price £ |

From | To | |

| Barbara Richmond | ||||||||||

| SAYE 2016 | 2,812 | 28/10/16 | 4.00 | - | - | - | 2,812 | 3.20 | 01/01/20 | 01/07/20 |

| SAYE 2017 | 1,836 | 30/10/17 | 6.12 | - | - | - | 1,836 | 4.90 | 01/01/21 | 01/07/21 |

| LTIP 2015 | 63,462 | 14/09/15 | 4.94 | 63,432 | - | - | - | 14/09/18 | 14/09/25 | |

| LTIP 2016 | 78,472 | 12/09/16 | 4.097 | - | - | - | 78,472 | 12/09/19 | 12/09/26 | |

| LTIP 2017 | 83,404 | 15/11/17 | 5.935 | - | - | - | 83,404 | 15/11/20 | 15/11/27 | |

| LTIP 2018 | - | 10/09/18 | 5.42 | - | 86,122 | - | 86,122 | 10/09/21 | 10/09/28 | |

| DEF BONUS 2016 | 19,130 | 12/09/16 | 4.097 | 19,130 | - | (19,310) | - | 12/09/17 | 12/09/26 | |

| DEF BONUS 2017 | 25,516 | 11/09/17 | 6.30 | 12,758 | - | - | 12,758 | 11/09/18 | 11/09/27 | |

| DEF BONUS 2018 | - | 10/09/18 | 5.42 | - | 27,062 | - | 27,062 | 10/09/19 | 10/09/28 | |

| 274,632 | 95,350 | 113,184 | (95,350) | 292,466 |

|

Awards held at 30 June 2018 |

Grant Date |

Share Price on Grant £ |

Award Vested |

Awards granted in year |

Awards Excercised in year |

Awards held at 30 June 2019 |

Excercise Price £ |

From | To | |

| Matthew Pratt | ||||||||||

| SAYE 2017 | 3,673 | 30/10/17 | 6.12 | - | - | - | 3,673 | 4.90 | 01/01/21 | 01/07/21 |

| LTIP 2016 | 30,022 | 12/09/16 | 4.097 | - | - | - | 30,022 | 12/09/19 | 12/09/26 | |

| LTIP 2017 | 23,168 | 15/11/17 | 5.935 | - | - | - | 23,168 | 15/11/20 | 15/11/27 | |

| LTIP 2018 | - | 10/09/18 | 5.42 | - | 23,951 | - | 23,951 | 10/09/21 | 10/09/28 | |

| DEF BONUS 2016 | 17,574 | 12/09/16 | 4.097 | 17,574 | - | (17,574) | - | 12/09/17 | 12/09/26 | |

| DEF BONUS 2017 | 23,693 | 11/09/17 | 6.30 | 11,847 | - | (11,847) | 11,846 | 11/09/18 | 11/09/27 | |

| DEF BONUS 2018 | - | 10/09/18 | 5.42 | - | 27,858 | - | 27,858 | 10/09/19 | 10/09/28 | |

| 98,130 | 29,421 | 51,809 | (29,421) | 120,518 |

|

Awards held at 30 June 2018 |

Grant Date |

Share Price on Grant £ |

Award Vested |

Awards granted in year |

Awards Excercised in year |

Awards held at 30 June 2019 |

Excercise Price £ |

From | To | |

| Steve Morgan* | ||||||||||

| LTIP 2010 | 78,625 | 18/02/11 | 1.30 | 78,625 | - | (78,625) | - | 18/02/14 | 19/04/21 | |

| LTIP 2011 | 367,012 | 21/09/11 | 1.10 | 367,012 | - | (367,012) | - | 21/09/14 | 20/09/21 | |

| LTIP 2012 | 271,739 | 23/10/12 | 1.54 | 271,739 | - | (271,739) | - | 23/10/15 | 22/10/22 | |

| LTIP 2013 | 183,158 | 24/09/13 | 2.37 | 183,158 | - | (183,158) | - | 24/09/16 | 24/09/23 | |

| LTIP 2014 | 162,105 | 08/09/14 | 2.85 | 162,105 | - | (162,105) | - | 08/09/17 | 08/09/24 | |

| LTIP 2015 | 96,154 | 14/09/15 | 4.94 | 96,154 | - | (96,154) | - | 14/09/18 | 14/09/25 | |

| LTIP 2016 | 118,867 | 12/09/16 | 4.097 | - | - | - | 118,867 | 12/09/19 | 12/09/26 | |

| DEF BONUS 2012 | 137,897 | 23/10/12 | 1.54 | 137,897 | - | (137,897) | - | 23/10/13 | 22/10/22 | |

| DEF BONUS 2013 | 73,264 | 24/09/13 | 2.37 | 73,264 | - | (73,264) | - | 24/09/14 | 24/09/23 | |

| DEF BONUS 2014 | 78,246 | 08/09/14 | 2.85 | 78,246 | - | (78,246) | - | 08/09/15 | 08/09/24 | |

| DEF BONUS 2015 | 46,761 | 14/09/15 | 4.94 | 46,761 | - | (46,761) | - | 14/09/16 | 14/09/25 | |

| DEF BONUS 2016 | 57,969 | 12/09/16 | 4.097 | 57,969 | - | (57,969) | - | 12/09/17 | 12/09/26 | |

| DEF BONUS 2017 | 63,651 | 11/09/17 | 6.30 | 38,651 | - | (38,651) | - | 11/09/18 | 11/09/27 | |

| 1,710,448 | 1,591,581 | - | (1,591,581) | 118,867 |

(i) The performance conditions attached to the 2017 LTIP awards were disclosed in the 2018 Directors’ Remuneration Report.

(ii) The performance conditions attached to the 2018 LTIP awards are shown on page 73.

(ii) There are no further performance conditions attached to the exercise of the deferred bonus awards.

(iv) Between 1 July 2019 and 3 September 2019 (being the latest practicable date prior to the posting of this report), there were no further changes to the directors’ interests set out in the Statement of shareholding and scheme interests above.

* All scheme interests held by Steve Morgan are receivable in cash on terms which in all other respects mirror those for other Executive Directors.

Gains made by Directors on Share Options

The table below outlines the notional gains made by Directors on share options exercised during the year, calculated as at the exercise date.

| Executive Director | Scheme |

No. shares exercised |

Date of exercise |

Mid price on date of exercise (pence) |

Notional gain on exercise (£'000) |

| John Tutte | LTIP 2015 | 112,348 | 17/09/18 | 622.65 | 699.53 |

| DEF Bonus 2016 | 33,866 | 06/02/19 | 626.85 | 212.29 | |

| DEF Bonus 2017 | 22,580 | 06/02/19 | 626.85 | 141.54 | |

| 168,794 | 1,053.36 | ||||

| Barbara Richmond | LTIP 2015 | 63,462 | 17/09/18 | 622.65 | 395.15 |

| DEF Bonus 2016 | 19,130 | 06/02/19 | 626.85 | 119.92 | |

| DEF Bonus 2017 | 12,758 | 06/02/19 | 626.85 | 79.97 | |

| 95,350 | 595.04 | ||||

| Matthew Pratt | DEF Bonus 2016 | 17,574 | 04/01/19 | 521.38 | 91.63 |

| DEF Bonus 2017 | 11,847 | 04/01/19 | 521.38 | 61.77 | |

| 29,421 | 153.40 |

Pension

John Tutte is a deferred member of the Redrow Staff Pension Scheme (now closed to future accrual) and details of entitlements under this plan are set out below. He also receives a pension allowance supplement of 20% of salary. Barbara Richmond receives a pension allowance supplement equivalent to 20% of salary and Matthew Pratt receives a contribution of 10% of salary. The value of these cash supplements is included in the pension column of the Single Total Figure of Remuneration Table on page 71. John Tutte, Barbara Richmond and Matthew Pratt are also covered by fixed term group income protection and death in service benefit.

Total Pension Entitlements (Audited)

Details of the Executive Directors’ pension entitlements under the defined benefit section of the Redrow Staff Pension Scheme are as follows:

|

Accrued benefit at 30 June 2019 |

Benefits paid to Director during period up to 30 June 2019 |

Defined Benefit accrued during period up to 30 June 2019 |

||

| Director | Normal retirement date | £ | £ | £ |

| John Tutte | 24 June 2021 | 56,912 | Nil | Nil |

| Matthew Pratt | 6 July 2040 | 15,106 | Nil | Nil |

The normal retirement date shows the date at which the Director can retire without actuarial reduction. No additional benefit is available on early retirement.

The accrued pension shown above is the amount of pension entitlement that would be paid each year on retirement on the normal retirement date, based on service to 29 February 2012. The Scheme closed the accrual of future benefits with effect from 1 March 2012.

Supporting Disclosures and Additional Context

Percentage change in remuneration of Executive Chairman

The table below shows the percentage change in the salary, benefits and annual bonus of the Executive Chairman and of all Redrow employees who qualify for participation in the Company’s bonus and benefits plans between 2018 and 2019.

|

Executive Chairman |

All Redrow employees |

|

| Salary | 2.0% | 2.31% |

| Benefits | Nil% | 13.9% |

| Annual bonus | (6.7%) | (15.7%) |

Relative importance of spend on pay

The table below shows total employee remuneration and distributions to shareholders, in respect of 2019 and 2018 (and the difference between the two).

| £m | 2019 | 2018 | Change (%) |

| Total employee remuneration | 141 | 139 | 1.4% |

| Distributions to shareholders | 220 | 103 | 113.6% |

Total employee remuneration represents amounts included in note 7a to the accounts in respect of wages, social security, pension and incentive costs for all Group employees. Distributions to shareholders include the cash returns in respect of each financial year (see note 5 to the financial statements). This represents 60.5 pence per share in respect of 2019 including the B share cash return compared to 28 pence per share in respect of 2018.

Performance graph and table

The chart below shows the TSR of Redrow in the ten-year period to 30 June 2019 against the TSR of the FTSE 250. TSR refers to share price growth with re-invested dividends. The Committee believes the FTSE 250 index is the most appropriate index against which the TSR of Redrow should be measured, as it is a constituent of the FTSE 250.

The table below provides remuneration data for the Executive Chairman/Group Chief Executive (as applicable) for each of the nine financial years over the equivalent period.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Name |

Steve Morgan |

Steve Morgan |

Steve Morgan |

Steve Morgan |

John Tutte |

John Tutte |

John Tutte |

John Tutte |

John Tutte |

| Remuneration/donations* | £582k | £855k | £1,050k | £1,922k | £2,355k | £1,916k | £2,463k | £1,950k | £1,923k |

| Bonus (% of Maximum) | 50% | 50% | 80% | 100% | 100% | 100% | 100% | 96.7% | 85% |

| LTIP vesting (% of Maximum) | 0% | 0% | 19% | 100% | 100% | 100% | 100% | 100% | 100% |

* For Steve Morgan, this value includes the nominal salary and benefits disclosed in the Single Total Figure of Remuneration table as well as Company donations to The Steve Morgan Foundation, a UK registered charity of which Steve Morgan is a trustee, reflecting notional salary and waived annual cash bonus in respect of the relevant year, as disclosed in the footnotes to the Single Total Figure of Remuneration Table and in the Directors’ Report on page 84 and in note 22 to the financial statements. It also includes the value of deferred bonus and vested LTIP cash awards in respect of each relevant year (calculated in accordance with the methodology applicable to the Single Total Figure of Remuneration Table).

External non-executive directorships held by Executive Directors

It is the Committee’s policy that, with the approval of the Board, Executive Directors may hold one non-executive directorship at another company in order to broaden their knowledge and experience to the benefit of the Company. The Executive Director may retain any fee received for these duties. Barbara Richmond is a non-executive director of Lonza Group Ltd and in line with the Committee’s policy, she is entitled to retain the fees from this appointment. She received fees of £169k during 2019 (£169k during 2018). This represented 240,000 Swiss Francs in both years.

Consideration of directors’ remuneration – Remuneration Committee and advisors

The Remuneration Committee is comprised solely of Non-Executive Directors and comprises Vanda Murray as Chair, Nick Hewson and Sir Michael Lyons. Debbie Hewitt stepped down from the Committee at the AGM on 7 November 2018.

The Committee has agreed Terms of Reference detailing its authority and responsibilities. The Terms of Reference of the Committee are kept under regular review and are published on the Group’s website and include:

- determining the Remuneration Policy in respect of the Executive Directors and the Company Secretary (together ‘the Senior Executives’), taking into account the context of the Company’s overall approach to remuneration for all employees and within this Policy determining the total individual package of each Senior Executive;

- determining performance targets and the extent of their achievement for both annual and long-term incentive awards operated by the Company affecting Senior Executives; and

- monitoring and approving the level and structure of remuneration of the Executive Committee immediately below the Senior Executives.

The Committee meets as often as is required but at least twice per year. The Committee met four times during the course of the financial year ended 30 June 2019 and details of Committee attendance are set out in the following table.

Table of Attendance

| Name | Role | Attendance at Meetings |

| Vanda Murray | Chair | 4/4 |

| Nick Hewson | Member | 4/4 |

| Sir Michael Lyons | Member | 4/4 |

| Debbie Hewitt* | Chair | 1/1 |

* Debbie Hewitt retired from the Board following the close of the AGM on 7 November 2018 at which point, Vanda Murray became Chair of the Remuneration Committee.

The Committee received advice from Deloitte LLP until February 2019. Following a selection process undertaken by the Committee, the Remuneration Committee appointed FIT Remuneration Consultants LLP (“FIT”) as its independent advisor and FIT provided advice to the Committee for the remainder of the year. Both FIT and Deloitte LLP are members of the Remuneration Consultants Group and as such voluntarily operate under the Code of Conduct in relation to executive remuneration consulting in the UK. The Committee is comfortable that neither the FIT nor Deloitte LLP engagement partners and teams that provided remuneration advice to the Committee have connections with Redrow plc that may impair their objectivity and independence. The fees charged by FIT and Deloitte LLP for the provision of independent advice to the Committee during 2019 were £24k and £2k respectively. During the year, Deloitte LLP provided the Company with tax advisory services but does not have any other connection with the Company. FIT provided no other services to the Company.

Statement of voting at Annual General Meeting

At the Annual General Meeting held on 6 November 2018, votes cast by proxy and at the meeting in respect of directors’ remuneration report are shown in the table.

| Votes For | Votes Against |

Total votes cast exc withheld |

Votes withheld |

|||

| Resolution | No. | % | No. | % | ||

|

Approval of Directors' Remuneration Report for year ended 30 June 2018 |

293,829,228 | 99.35% | 1,909,852 | 0.65% | 295,739,080 | 598,132 |

By order of the Board

VANDA MURRAY OBE

Chair of the Remuneration Committee

4 September 2019